In the first half of 2025, China’s cumulative electricity consumption reached 484.18 billion kWh, representing a year-on-year increase of 3.70%. With the gradual implementation of a series of policies to promote consumption, industrial electricity consumption in some provinces began to pick up with stabilizing growth of electricity demand in the second quarter this year. Meanwhile, the comprehensive launch of spot market for electricity trading and extensive application of new energy will continue to drive the green transformation of the economy and the society in all aspects.

Both wind power and photovoltaic power of the Company and its subsidiaries (the “Group”) continued to maintain revenue growth, resulting from the consolidation of several wind power and photovoltaic power project companies into the Group as part of the Proposed Asset Pre-Restructuring (please refer to the Company’s announcement dated 17 January 2025, and the following section titled “Material Acquisitions and Disposals” for details), as well as the acquisitions and commencement of operations of various new power generating units during the period. The reclassification of a wind power company from an associate to a subsidiary of the Company after we obtained its controlling stake in the second quarter of last year also further contributed to the profit growth of the wind power segment during the period.

The Group’s thermal power segment was benefited from reduction in fuel costs and implementation of effective coal procurement measures, which contributed to a positive profit growth during the period under review. However, the reclassification of a coal-fired power generation company with a total installed capacity of 1,260MW from a subsidiary to an associate of the Company at the end of last year (please refer to the Company’s announcement dated 31 December 2024 for details), coupled with the shift in the function of coal fired power to primarily focus on frequency modulation and peak-load shaving to stabilize power supply within the power system, resulted in a year-on-year decline in electricity sales and revenue.

The Group’s photovoltaic power experienced a year-on year decline in profit, primarily due to the adjustments in average on-grid tariff resulting from the implementation of the market-based renewable energy tariff policy. The reduced rainfall in the regions where the Group’s hydropower plants are located as compared to the corresponding period last year also resulted in the overall decrease in both revenue and profit from hydropower segment.

For the six months ended 30 June 2025, the profit attributable to equity holders of the Group amounted to RMB2,834,655,000 (2024: RMB2,802,197,000). Profit attributable to ordinary shareholders of the Company amounted to RMB2,586,638,000 (2024: RMB2,569,879,000). Basic earnings per share was approximately RMB0.21 (2024: RMB0.21). As at 30 June 2025, net assets per share (excluding non controlling interests and other equity instruments) was approximately RMB3.24.

During the period under review, the development and performance of the Group’s principal businesses were as follows:

As at 30 June 2025, the consolidated installed capacity of the Group’s power plants was 53,940.6MW, representing a year-on-year increase of 5,612.8MW or 11.61%. The Group’s consolidated installed capacity of clean energy (inclusive of hydropower, wind power, photovoltaic power, natural gas power and environmental power) was 44,120.6MW, accounting for approximately 81.79% of the total consolidated installed capacity of the Group, and representing an increase of approximately 4.72 percentage points as compared with the corresponding period last year.

The details of consolidated installed capacity of the Group as at 30 June 2025 are set out as follows:

The Group’s power generating units that commenced commercial operation and those that were acquired during the period from 1 July 2024 to 30 June 2025 presented by type are set out as follows:

The year 2025 is a critical year that sets the stage for transitioning to and planning of the national “15th Five-Year” plan. The Company will actively support the national initiative by focusing on the development of green and low-carbon energy, accelerating the construction of new power systems, and staying committed to high-quality development. The status of key projects during the period under review are as follows:

Integrated Wind-Photovoltaic-Thermal-and-Storage Demonstration Project of CP Pu’an

The Integrated Wind-Photovoltaic-Thermal-and-Storage Demonstration Project of China Power (Pu’an) New Energy Co., Ltd. (中電(普安)新能源有限責任公司), a subsidiary of the Company, has a planned installed capacity of 1,000MW, including 700MW of photovoltaic power generation, 300MW of wind power generation and energy storage facilities at different stages. Located in Guizhou Province, the PRC, the project adopts centralized-controlled intelligent dispatching to realize 24-hour monitoring of equipment operation across all power plants. With in-depth integration of advanced models such as the development concept of smart power stations, the project ensures excellent, safe and efficient operation. It is not only one of the key projects in Guizhou Province’s “14th Five-Year” plan for power development, but also a representative example of energy structure innovation and excellence in regions covered by the Southern Power Grid. In the first half of 2025, Xicaochong and Jinzhuping photovoltaic power stations under the project, with a total capacity of 146MW, were connected to the power grid for power generation and commenced commercial operation. The project can effectively reduce the emission of air pollutants to improve environmental quality, at the same time promoting diversification and transformation of local industries to help addressing challenges related to local employment.

Integrated Source-Grid-Load-and-Storage Project of Xinjiang Power

The 300MW Integrated Source-Grid-Load-and-Storage Project of China Power Hutubi New Energy Co., Ltd. (中電呼圖壁新能源有限公司), a subsidiary of the Company, was connected to the power grid at full capacity in the first half of 2025. Located in Hutubi County, Xinjiang Uygur Autonomous Region, the PRC, the project was constructed by making full use of the abundant sunlight resources in the locality and is equipped with energy storage equipment of 75MW/300MWh. It is expected to save standard coal consumption and reduce carbon dioxide emission on an annual basis, hence help mitigating environmental pollution, protecting the ecological environment and promoting local economic development.

Dajia Pingge Hydropower-Photovoltaic Complementary Agricultural Photovoltaic Power Generation Project

The 200MW Hydropower-Photovoltaic Complementary Agricultural Photovoltaic Power Generation Project of Liping Qingshuijiang New Energy Co., Ltd. (黎平清水江新能源有限公司), a subsidiary of the Company, has commenced commercial operation at full capacity in the first half of 2025. Located in Liping County, Guizhou Province, the PRC, the project fully utilizes renewable energy without occupying basic farmland and woodland. As no exhaust gas, wastewater or solid waste would be generated in the process of power generation, the process can effectively protect the local environment and realize the integration of diversified industrial development and rural revitalization.

Liumaohu Wind Power Project

The 200MW wind power project of Mishan Beiling Wind Power Generation Co., Ltd. (密山市北嶺風力發電有限公司), a subsidiary of the Company, was connected to the power grid and commenced operation at full capacity in the first half of 2025. Located in Heilongjiang Province, the PRC, the project is equipped with 40 wind turbines, including the construction of energy storage and peak-load shaving systems as ancillary facilities. It is expected to save standard coal consumption and reduce carbon dioxide emission on an annual basis, providing major support for the development of integrated energy systems in Mishan City and Heilongjiang Province.

Binzhou Fishery-Photovoltaic Complementary Photovoltaic Power Generation Project

The 200MW Fishery-Photovoltaic Complementary Photovoltaic Power Generation Project of Binzhou Power Investment New Energy Development Co., Ltd. (濱州電投新能源發展有限公司), a subsidiary of the Company, has been put into operation in the first half of 2025. Located in Shandong Province, the PRC, the project makes full use of the salt-alkali tidal flat land resources to promote in-depth integration of photovoltaic power generation and the fishery industry, which effectively facilitates the green and low-carbon transformation and creates vast job opportunities in the locality, playing an active role in promoting steady growth and structural adjustment and improving people’s livelihood in the local region.

Datonghu Fishery-Photovoltaic Complementary Photovoltaic Power Generation Project

The 290MW Fishery-Photovoltaic Complementary Photovoltaic Power Generation Project of China Power (Datonghu) Energy Development Co., Ltd. (中電(大通湖)能源發展有限公司), a subsidiary of the Company, has commenced commercial operation in the first half of 2025. Located in Hunan Province, the PRC, the project includes the construction of a 220kV booster station and a 220kV transmission line as ancillary facilities. The photovoltaic power station is designed based on the principle of “unmanned shift and minimal staff on duty”. It adopts a fishery-photovoltaic complementary model of “power generation on the solar panels while fish farming below” to realize efficient and compound use of land resources. The project can save standard coal consumption, reduce emissions of carbon dioxide, sulfur dioxide and nitrogen oxides, and promote the clean use of energy in rural areas, thereby bringing significant economic, environmental and social benefits for the fishery industry, the power industry and environmental protection.

The Group accelerated the promotion of technological innovation and stepped up its investment in technological research and development. By focusing on key technological innovations and development of digitalization and intelligence, it aimed to further consolidate its competitive edge in the clean energy sector. In addition, we have actively nurtured and introduced high-end technological talents, accelerated the incubation of energy-related strategic emerging industries, thereby promoting the practical application of energy-related technological innovation achievements.

Intelligent Energy Storage

During the period under review, Xinyuan Smart Storage Energy Development (Beijing) Co., Ltd. (“Xinyuan Smart Storage”), a subsidiary of the Company, achieved major breakthroughs in aspects such as research and development of energy storage systems, market expansion and operational capabilities. A total of 17 energy storage projects in relation to EPC contracting and equipment integration with a total capacity of 3.23GWh were launched during the period, ranking second nationally in terms of the scale of successful bids. There are also 42 projects in pipeline. In addition, Xinyuan Smart Storage launched a number of novel energy storage products and core control systems, including a 5MWh AC/DC integrated central control unit and a SEC2000 energy storage monitoring and energy management system. As Xinyuan Smart Storage continued to step up its brand building efforts, it has garnered nearly 10 major industry awards, which further consolidated its technological advantages and market-leading position in China’s energy storage sector.

Green Power Transportation

In the first half of 2025, Shanghai Qiyuanxin Power Technology Co., Ltd. (“Qiyuanxin Power”), an associate of the Company, achieved notable results in both the domestic and international market. Qiyuanxin Power entered into a contract with Rio Tinto Group (力拓集團), an international mining giant, to launch a mine-use electric mining truck transportation project at the Oyu Tolgoi Mine of Rio Tinto Group in Mongolia, aiming to establish a new international benchmark for green mining. Domestically, Qiyuanxin Power deepened its collaborations with various mining enterprises to push forward the development of unmanned green transportation capacity. Meanwhile, the completion of the 1,200-kilometer G110 National Highway, the longest heavy-duty truck charging and battery-swap highway nationwide, further consolidated its leading position in China’s charging and battery-swap network. In terms of technological innovation, Qiyuanxin Power further upgraded its battery systems, introducing vehicle-mounted storage-shared batteries with higher energy density. In addition to the development of a power-grid-friendly super recharge center featuring super-charging + fast-swapping + power transmission functions, it also leveraged the characteristics of vehicle-mounted storage-shared batteries to widely promote the mobile power transmission business for applications in scenarios such as film production, construction sites and high-speed emergency recharge, thereby enhancing the efficiency of resource utilization and expanding the market coverage of its brand.

As at 30 June 2025, the consolidated installed capacity of the projects under construction was 3,591.1MW, all of which were clean energy projects and consisted of various large-scale wind power and photovoltaic power generation projects in Guizhou Province, Jiangsu Province, Guangxi Zhuang Autonomous Region, Hunan Province and Anhui Province.

Currently, the total installed capacity of new projects of the Group at a preliminary development stage (including projects with applications submitted to the PRC government for approval) is approximately 30,000MW, all of which are clean energy projects, and are primarily located in areas with development potential, such as Shandong Province, Guangxi Zhuang Autonomous Region, Xinjiang Uygur Autonomous Region and Shanxi Province. Such projects include the Shandong Peninsula South Offshore Wind Power Project with a total installed capacity of 7,000MW, Phase I of 2,000MW Offshore Wind Power Project in the eastern state-controlled waters of Rizhao, Shandong, Qinzhou 900MW Offshore Wind Power Demonstration Project, Xinjiang China Power Altay City 600MW Wind Power Project and others.

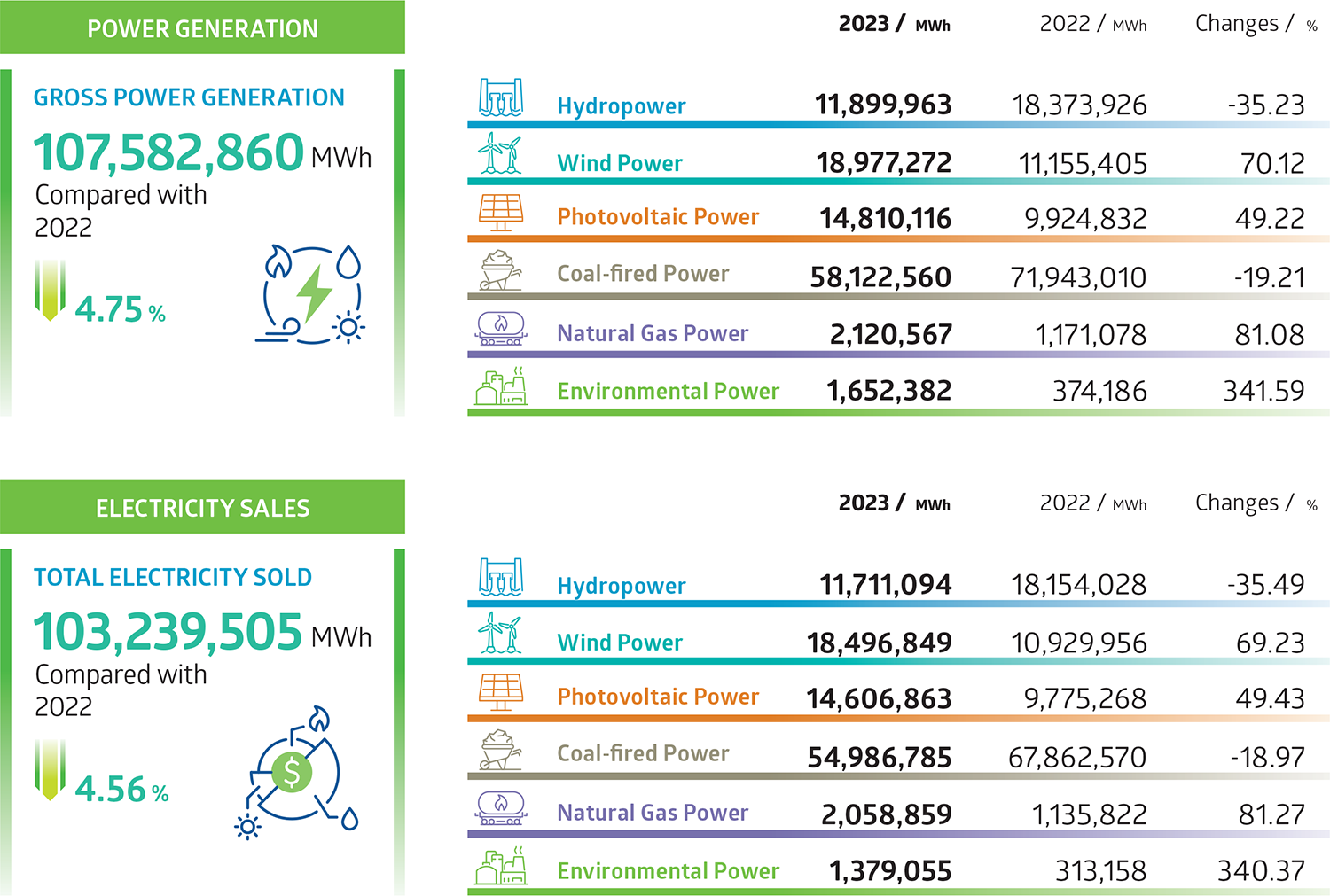

For the first half of 2025, the details of power generation and electricity sold by the Group are set out as follows:

Power Generation

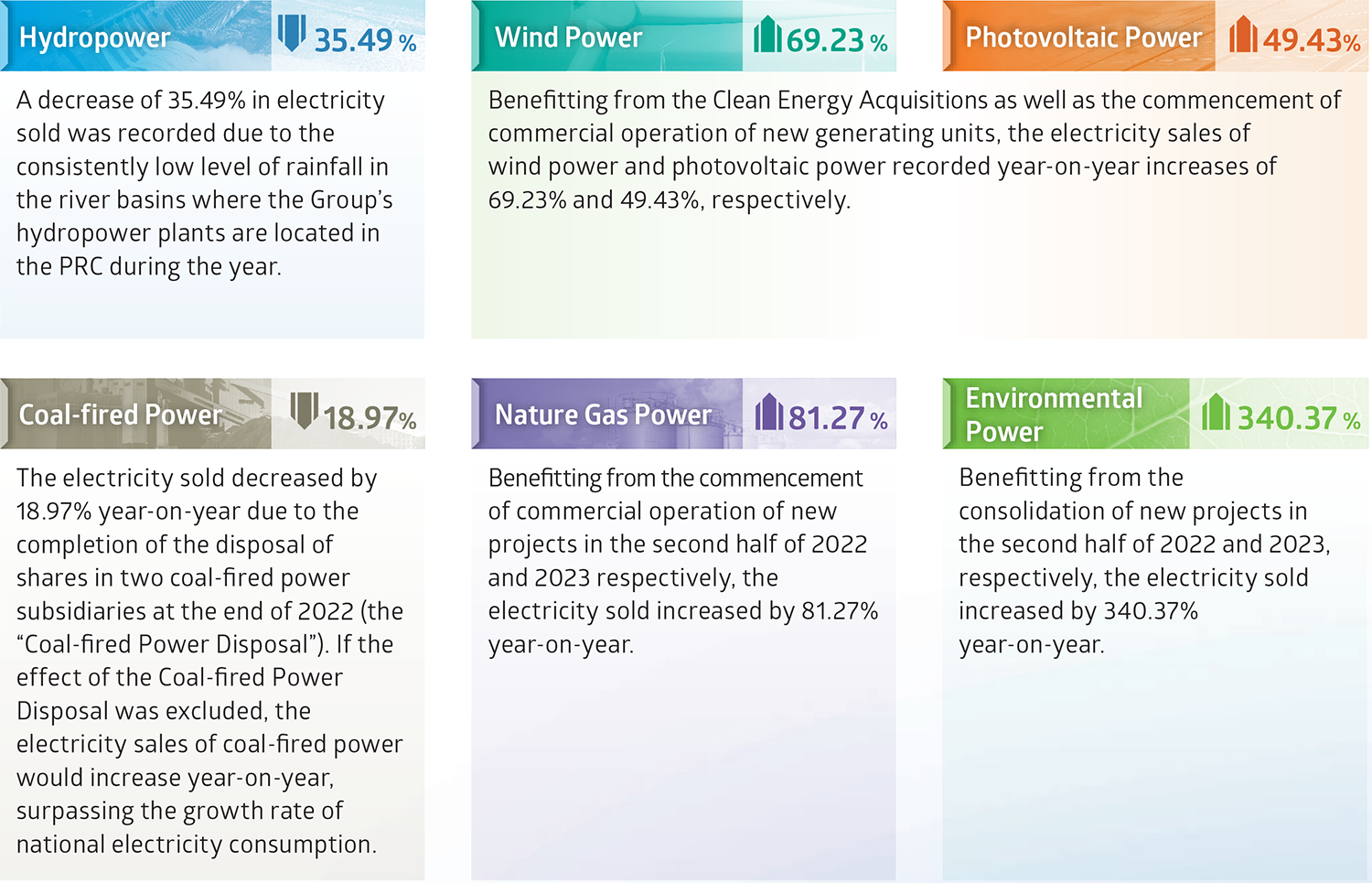

For the first half of 2025, the total electricity sold by the Group amounted to 62,536,560MWh, representing a decrease of 2.81% as compared with the corresponding period last year. The changes in electricity sold by each power segment as compared with the corresponding period last year are as follows:

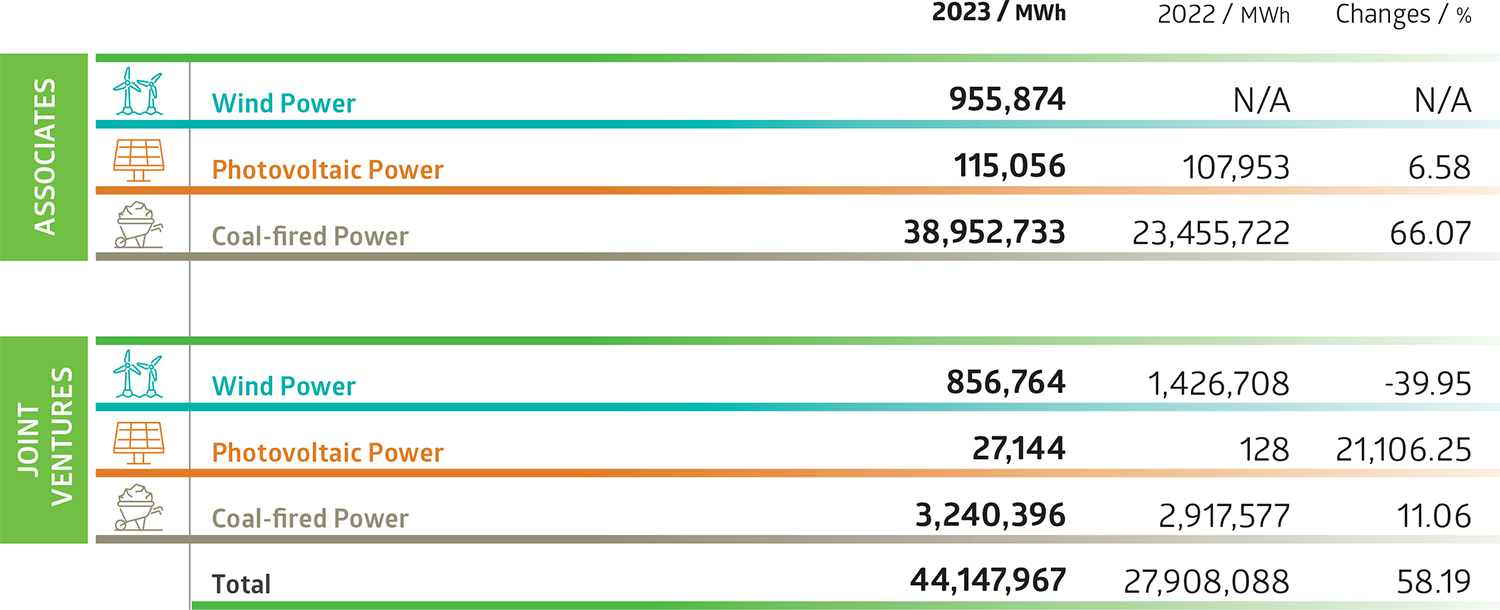

For the first half of 2025, the details of electricity sold by the Group’s main associates and joint ventures are set out as follows:

For the first half of 2025, the total heat sold by the Group’s subsidiaries reached 13,122,422GJ, representing an increase of 1,703,673GJ or 14.92%, as compared to the corresponding period last year. This growth was primarily benefited from the Group’s proactive market expansion initiatives, which significantly expanded its customer base as well as increased demand for heat. Conversely, the Group’s main associates and joint ventures recorded total heat sold of 9,292,303GJ, representing a decrease of 100,383GJ, or 1.07%, year-on-year, mainly due to reduced heat supply area of an associate. The heat sales of the Group were classified as other gains and losses in the consolidated statement of profit or loss. During the period, profits generated from sales of heat, trading of coal, coal by-products, spare parts and others totaled RMB147,136,000 (2024: RMB144,966,000), representing an increase of 1.50% as compared to the corresponding period last year.

For the first half of 2025, in order to enhance its heat supply capacity, the Group undertook several renovation projects, including the Fuxi Power Plant Siliya Heat Supply Renovation Project, the Sanjiang New Area Sichuan Times Heat Supply Renovation Project, the Shentou Power Central Heat Supply Project, the Shangqiu Thermal Power Heat Supply Network First Station Renovation Project, the Bazhou Environmental Oilfield Farm Heat Supply Engineering Project, the Aileda Tuowei Branch Pipeline Network Construction Project of China Power (Chengdu) Comprehensive Energy Co., Ltd. and other projects, all of which will contribute to the continuous improvement of its heat supply capacity.

The Group has actively engaged in the market-oriented reform of the national power industry and strengthened its research on power market policies and regulations, particularly in aspects such as the trading of spot electricity, green certificate/green power and carbon emission allowances. The Group has maximized its market power sales and expanded its market share through increased participation in market-power transactions. Subsidiaries in various provinces have also established their power sales centers, leveraging quality services to attract and retain target customers. During the period under review, the trading volume of green certificate and green power increased by approximately 10% year-on-year.

In 2024, the new tariff for coal-fired power was implemented nationwide to optimize coal-fired power revenues through a dual structure of “capacity tariff” plus “volume tariff”. While the premium margin in market-traded power tariffs experienced a slight decline, primarily due to increased participation of other power sources in the spot market, which drove down market-traded power tariffs, the capacity tariff (i.e. determined by way of the calculation based on recovering a certain percentage of the fixed costs of the coal-fired power generating units) provided a stable comprehensive tariff.

For the first half of 2025, all the power production quota of large-scale coal-fired power generating units of the Group were obtained from the market transactions, and the proportion of market transactions to sales was 100% (2024: 100%).

The average market on-grid tariff was at a premium of approximately 7.09% over the benchmark tariff, as compared to that of 12.43% in 2024.

Despite the decrease in market-trading-tariff, the comprehensive tariff after taking into account the capacity-tariff basically remained stable, which demonstrated the adjusting effect of the capacity-tariff policy on market-trading-tariff.

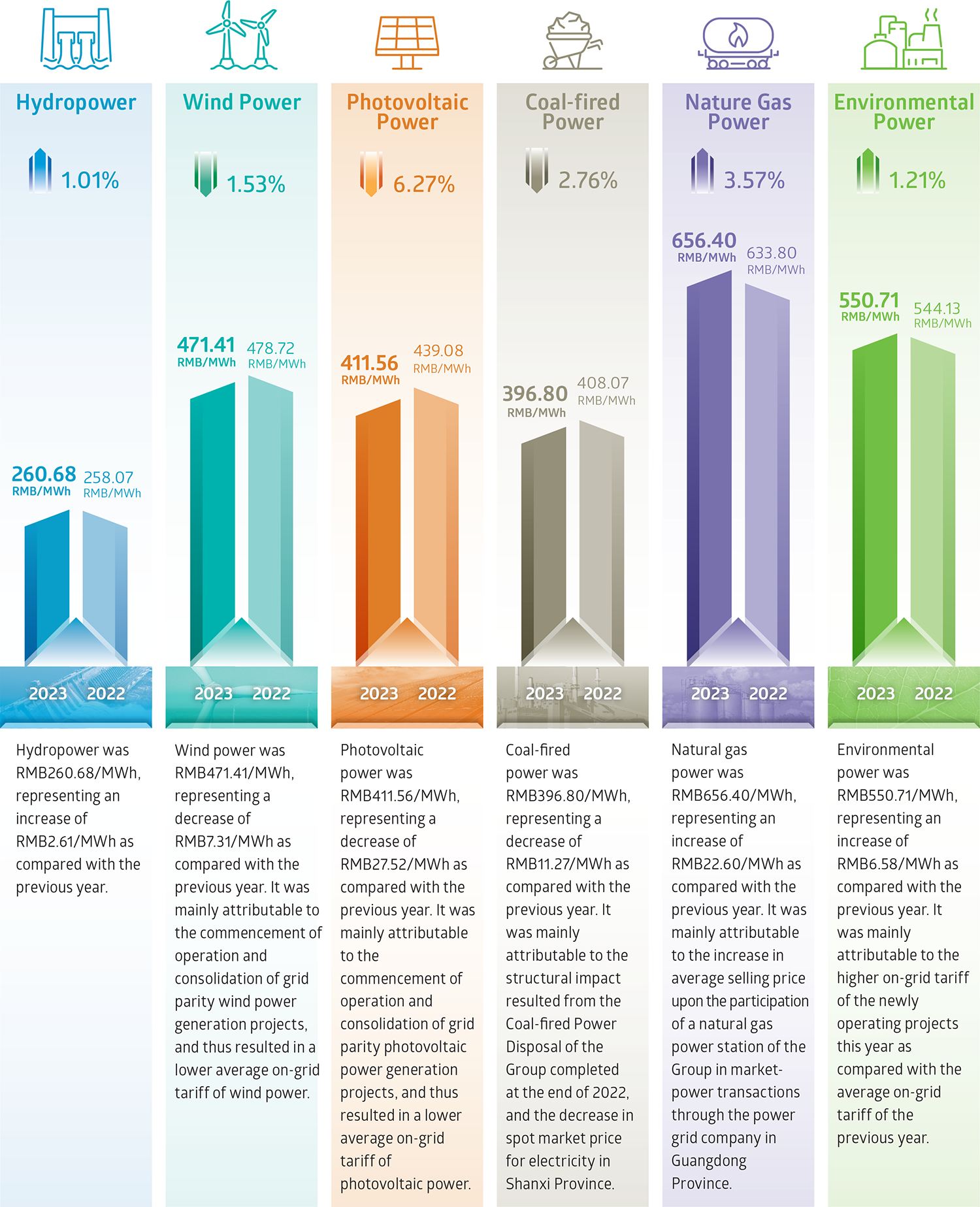

Starting 1 June 2025, all electricity generated by China’s renewable energy power sources, including photovoltaic power as well as onshore and offshore wind power, shall fully participate in the power market and be traded at market prices. In this context, the average on-grid tariffs of electricity generated by the Group across each power segment for the first half of 2025, compared with the corresponding period last year, were as follows:

For the first half of 2025, the average utilization hours of power generating units of each power segment of the Group as compared with the corresponding period last year were as follows:

The average utilization hours of hydropower were 1,387 hours, representing a decrease of 434 hours as compared with the corresponding period last year. It was mainly attributable to the decrease in power generation as a result of the decrease in the average rainfall in the river basins where the Group’s hydropower plants are located during the period.

As the energy storage business has a relatively long delivery cycle, the orders received in the first half of the year have not yet met the conditions for revenue recognition, accordingly, year-on-year decreases were recorded in both revenue and profit. Revenue from the energy storage business amounted to RMB257,378,000, representing a year-on-year decrease of RMB1,270,608,000 or 83.16%. Net loss during the period was RMB5,826,000.

| Address | Suite 6301, 63/F, Central Plaza, 18 Harbour Road, Wanchai, Hong Kong |

| Phone | (852) 2802-3861 |

| Fax | (852) 2802-3922 |

| ir@chinapower.hk |