Operating Results

For the first half of 2025, the net profit of the Group amounted to RMB4,611,209,000, representing an increase of RMB19,446,000 or 0.42% as compared with the corresponding period last year.

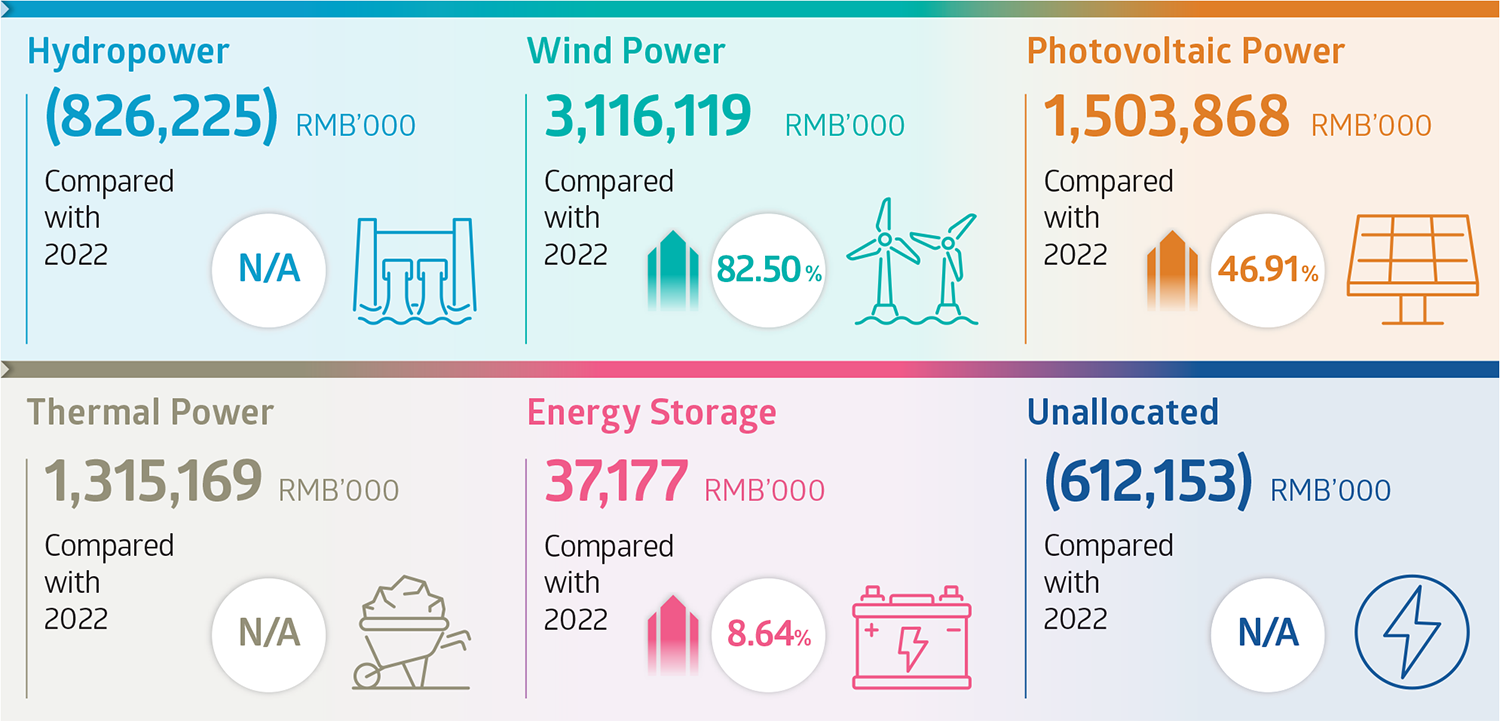

For the first half of 2025, the net profit (loss) of each operating segment and their respective changes over the corresponding period last year were as follows:

As compared with the first half of 2024, the changes in net profit were mainly due to the following factors:

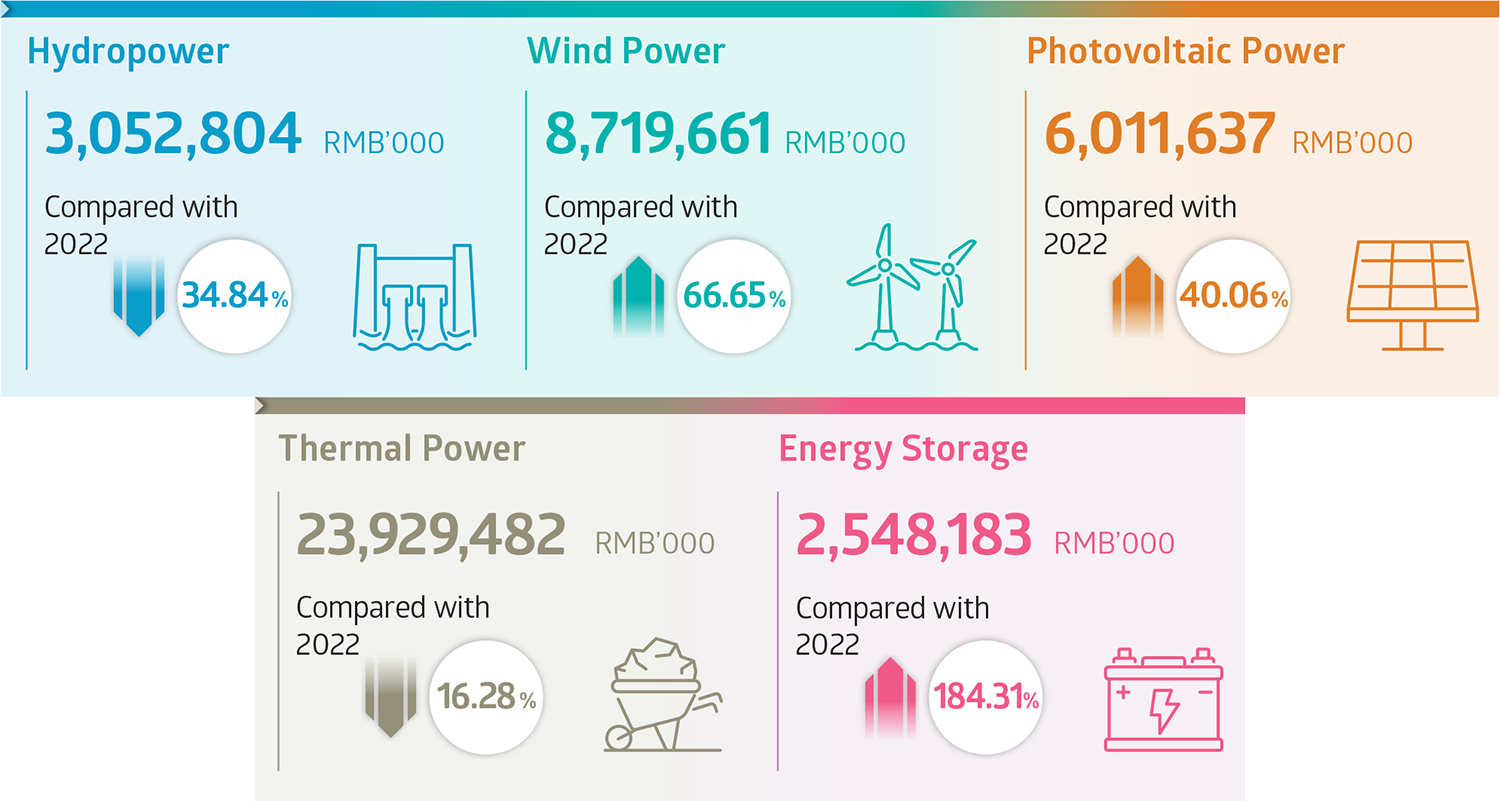

The revenue of the Group was primarily derived from the sales of electricity, as well as the provision of power generation and energy storage-related services. For the first half of 2025, the Group recorded a revenue of RMB23,857,644,000, representing a decrease of 9.87% as compared to RMB26,471,527,000 of the corresponding period last year.

For the first half of 2025, the details of revenue of each operating segment are set out as follows:

Revenue from hydropower decreased by RMB400,102,000, which was attributable to the decrease in the average rainfall in the river basins where the Group’s hydropower plants are located during the period.

Revenue from wind power and photovoltaic power increased by RMB1,125,947,000 in total, primarily due to the consolidation of several project companies as part of the Proposed Asset Pre-Restructuring, as well as the acquisitions and commencement of operations of various new power generating units during the period.

Revenue from thermal power decreased by RMB2,069,120,000 year-on-year, primarily due to the reclassification of Pingwei Power from a subsidiary to an associate of the Company at the end of last year.

Revenue from energy storage decreased by RMB1,270,608,000 year-on-year. The decrease was mainly due to the fact that given the relatively long delivery cycle of the energy storage business, the orders received in the first half of the year have not yet met the conditions for revenue recognition and the recognition of revenue was hence being postponed to the second half of the year.

Operating costs of the Group mainly consist of fuel costs, repairs and maintenance expenses for power generating units and facilities, depreciation and amortization, staff costs, subcontracting costs, cost of sales of energy storage equipment, consumables, and other operating expenses. For the first half of 2025, the operating costs of the Group amounted to RMB17,892,374,000, representing a decrease of 11.81% as compared to RMB20,289,101,000 in the corresponding period last year. The decrease was primarily driven by a year-on-year decrease in both fuel costs and cost of sales of energy storage equipment.

Total Fuel Costs

The total fuel costs decreased by RMB2,072,400,000 or 26.16%. The decline was mainly attributed to the reclassification of Pingwei Power (engaged in coal-fired power generation) from a subsidiary to an associate of the Company at the end of last year, as well as a decrease in unit fuel cost.

Unit Fuel Cost

The average unit fuel cost of the Group’s coal-fired power business was RMB234.52/MWh, representing a decrease of 14.41% as compared to RMB274/MWh in the corresponding period last year. For the first half of 2025, domestic coal demand was lower than expected, while supply recovered and grew, maintaining an eased supply-demand balance that exerted downward pressure on thermal coal prices. In order to further reduce fuel costs, the Group continued optimizing its procurement structure to capitalize on falling coal prices, which allowed for increased purchases of market coal and imported coal to supplement or replace coal supply under long-term contracts.

Depreciation and Staff Costs

Depreciation of property, plant and equipment and the right-of-use assets and staff costs increased by RMB884,174,000 in aggregate, the rise was primarily due to the consolidation, acquisitions and commencement of operations of various new power generating units in the wind power and photovoltaic power segments during the first half of the year.

Cost of Energy Storage Equipment Sales and Subcontracting Costs

The Group’s energy storage segment is principally engaged in sales of energy storage equipment and the provision of subcontracting services for the development and assembly of power stations integrated with energy storage. As the energy storage business has a relatively long delivery cycle, the orders received in the first half of the year have not yet met the conditions for revenue recognition and the recognition of both revenues and costs was hence being postponed to the second half of the year, which has affected the performance of our energy storage business during the period. As a result, the cost of sales of energy storage equipment and subcontracting costs in the first half of 2025 amounted to RMB87,027,000, indicating a decrease of RMB1,244,753,000 or 93.47% as compared to the corresponding period last year.

Other Operating Expenses

Other operating expenses increased by RMB146,201,000, or 6.51%, year-on-year, primarily due to an increase in other taxes and surcharges.

The net gains from other gains and losses increased by RMB157,600,000, or 55.41%, year-on- year. The increase was primarily driven by the gain on bargain purchase from the acquisitions of new energy project companies associated with the Proposed Asset Pre-Restructuring, an increase in government subsidies, and a year-on-year decrease in the impairment of property, plant and equipment.

For the first half of 2025, the Group’s operating profit was RMB7,611,019,000, representing an increase of 1.94% as compared to the operating profit of RMB7,466,308,000 in the corresponding period last year.

For the first half of 2025, the finance costs of the Group amounted to RMB2,574,596,000 (2024: RMB2,575,678,000). This represents a decrease of RMB1,082,000, or 0.04%, as compared to the corresponding period last year. By actively advancing its debt optimization initiatives, including adjusting the interest rate structure and seeking preferential loan conditions, the Group effectively controlled the rise in finance costs, thereby offsetting the impact of increased finance costs driven by capital investments. Looking ahead, the Group will continue to monitor market changes and seize opportunities presented by lower financing interest rates to further optimize its debt structure by replacing high-interest borrowings.

For the first half of 2025, the profits from the Group’s share of results of associates was RMB372,766,000, representing an increase of RMB5,902,000, or 1.61%, as compared to the corresponding period last year. The reclassification of Pingwei Power from a subsidiary to an associate of the Company at the end of last year, combined with a decrease in unit fuel costs during the first half of the year, contributed positively to the growth in the Company’s share of results of associates. However, this growth was partly offset by the reclassification of a wind power generation company from an associate to a subsidiary of the Company in the second quarter of last year.

For the first half of 2025, the profits from the Group’s share of results of joint ventures was RMB133,044,000, representing an increase of RMB16,269,000, or 13.93%, as compared to the corresponding period last year. The increase in the share of results of joint ventures was primarily attributable to improvements in the joint venture’s coal-fired power business, facilitated by a decrease in unit fuel costs and an increase in electricity sales.

For the first half of 2025, the income tax expense of the Group was RMB997,791,000, representing an increase of RMB120,742,000, or 13.77%, as compared to the corresponding period last year. The increase in income tax was primarily due to the consolidation of several project companies as part of the Proposed Asset Pre-Restructuring, and also the increase in profit from wind power segment during the period.

In August last year, the board of directors of the Company (the “Board”) resolved to declare a one-off special dividend of RMB0.05 per ordinary share in cash to reward our shareholders for their long-standing support and in celebration of the 20th anniversary of the Company’s listing on The Stock Exchange of Hong Kong Limited (the “Hong Kong Stock Exchange”).

The Board has resolved not to distribute any interim or special dividend for the six months ended 30 June 2025. The non-declaration of any interim or special dividend will not affect the Company’s commitment to maintaining an annual target dividend payout ratio of not less than 50% for the whole year of 2025.

As at 30 June 2025, the carrying amount of equity instruments at FVTOCI was RMB4,960,145,000, accounting for 1.41% of total assets, including listed equity securities of RMB3,193,338,000 and unlisted equity investments of RMB1,766,807,000.

Listed equity securities represent the equity interests in Shanghai Electric Power Co., Ltd. (“Shanghai Power”) held by the Group. As at 30 June 2025, the Group held 12.90% (31 December 2024: 12.90%) of the issued share capital of Shanghai Power, the A shares of which are listed on the SSE. They were categorized as level 1 financial assets of fair value measurements, and their fair values decrease by 4.14% as compared with RMB3,331,389,000 as at 31 December 2024.

Unlisted equity investments represent the Group’s investment in equity of certain unlisted companies principally engaged in financial services, coal production and electricity trading services respectively. They were categorized as level 3 financial assets of fair value measurements, and their fair values increased by 0.40% from RMB1,759,716,000 as at 31 December 2024.

The valuation methods and key inputs used for measuring the fair values of the above level 3 financial assets were market approach, i.e. fair values of such equity instruments were estimated by calculating the appropriate value ratio based on market multiples derived from a set of comparable listed companies in the same or similar industries. Key inputs were (i) the market value of the said equity interests, (ii) price-to-book ratio (1.80) and price-earning ratio (5.60) of the comparable companies. The fair value measurement is positively correlated to the above ratios and negatively correlated to the discount for lack of marketability.

The fair value loss on equity instruments at FVTOCI (net of tax) for the six months ended 30 June 2025 of RMB98,220,000 (2024: gain of RMB417,502,000) was recognized in the Interim Condensed Consolidated Statement of Comprehensive Income.

On 18 June 2025, the Company, China Power International Holding Limited (“CPI Holding”), SPIC Guangdong Power Co., Ltd. (“Guangdong Company”) and SPIC (Jieyang) Power Investment Co., Ltd. (“Jieyang Power”) entered into an equity transfer agreement, pursuant to which the Company agreed to acquire and Guangdong Company agreed to sell 35% equity interest in Jieyang Power at a consideration of RMB36,693,510 plus a post-completion capital contribution of RMB558,600,000, amounting to RMB595,293,510 in total. Jieyang Power, through its wholly-owned subsidiary, holds the development right to two ultra-supercritical coal-fired power generating units with total installed capacity of 2,000MW located in Guangdong Province, the PRC as well as the approval for the development right to an offshore wind power project in the state-controlled waters of Jieyang. The acquisition marks a joint-operation development model of coal-fired power with renewable energy. For details, please refer to the announcement of the Company issued on the same date.

On 16 April 2025, the Company and SPIC Guangxi Electric Power Co., Ltd. (“Guangxi Company”, a wholly-owned subsidiary of the Company) entered into equity transfer agreements with Yuanda Environmental (a company listed on the SSE), pursuant to which the Company and Guangxi Company has agreed to transfer their 63% and 64.93% equity interests in Wu Ling Power and Changzhou Hydropower, respectively, to Yuanda Environmental for the subscription of new shares to be issued by Yuanda Environmental plus cash consideration (the “Proposed Asset Restructuring”). For details of the transaction, please refer to the circular of the Company dated 20 May 2025.

To facilitate the implementation of the Proposed Asset Restructuring, Wu Ling Power and Changzhou Hydropower carried out a series of corporate reorganizations (the “Proposed Asset Pre-Restructuring”) prior to the Proposed Asset Restructuring, which mainly comprised: (1) external acquisitions by Wu Ling Power entered into on 17 January 2025; (2) formation of two new subsidiaries; and (3) intra-group reorganization. For details regarding the Proposed Asset Pre-Restructuring and the progress of completion of the external acquisitions of Wu Ling Power, please refer to the announcement of the Company dated 17 January 2025 and Note 28 to the Interim Condensed Consolidated Financial Information in this report.

Save as disclosed above, the Group did not have any other material acquisitions and disposals during the period under review.

In respect of the Proposed Asset Restructuring, the equity transfer agreements with Yuanda Environmental will take effect upon satisfaction of all the conditions precedent, amongst others, approval of the shareholders of both the Company and Yuanda Environmental, approval of the SSE and registration consent of the China Securities Regulatory Commission. The Proposed Asset Restructuring was duly approved at the general meeting of Yuanda Environmental held on 20 June 2025, and at the general meeting of the Company held on 24 June 2025. On 25 June 2025, the SSE accepted the application for the Proposed Asset Restructuring of Yuanda Environmental and commenced its review on the transaction in accordance with the applicable laws and regulations. As of the date of this report, the application is still under review by the SSE. The Company will timely publish updates regarding the Proposed Asset Restructuring as and when appropriate.

On 17 July 2025, the Company, CPI Holding, Pingmei Shenma (Xinjiang) Energy Co., Ltd., SPIC Xinjiang Energy Chemical Co., Ltd. (“Xinjiang Energy”) and Tuoli SPIC Power Generation Co., Ltd. (“Tuoli Power”) entered into an equity transfer agreement, pursuant to which the Company agreed to acquire and Xinjiang Energy agreed to sell 31% equity interest in Tuoli Power at a consideration of RMB24,212,147 plus a post-completion capital contribution of RMB285,820,000, amounting to RMB310,032,147 in total. Tuoli Power holds the development right to two ultra-supercritical coal-fired power generating units with a total installed capacity of 1,320MW located in Tuoli County, Tacheng Prefecture, Xinjiang Uygur Autonomous Region, the PRC. The acquisition aims to address the power supply shortfall in the region by leveraging a “coal plus coal-fired power joint operation” industrial model. For details, please refer to the announcement of the Company issued on the same date.

On 16 July 2025, the Company successfully issued a medium-term note for repayment of its existing debts, please refer to the following section titled “Issuance of Debt Financing Instruments” under “Significant Financing” for details.

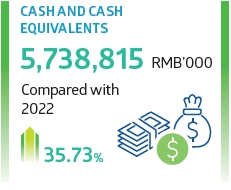

As at 30 June 2025, cash and cash equivalents of the Group were RMB8,884,645,000 (31 December 2024: RMB6,073,616,000). Current assets amounted to RMB58,156,902,000 (31 December 2024: RMB51,638,373,000), current liabilities amounted to RMB92,531,111,000 (31 December 2024: RMB93,182,359,000) and current ratio was 0.63 (31 December 2024: 0.55).

In May 2022, the Company entered into the financial services framework agreement with SPIC Financial Company Limited (國家電投集團財務有限公司) (“SPIC Financial”) for a term of three years, effective from 7 June 2022 to 6 June 2025, pursuant to which SPIC Financial has agreed to provide the Group with deposit services, settlement services, loan services and other financial services on a non-exclusive basis. The annual cap in respect of the maximum daily balance of deposit (including accrued interests) placed by the Group with SPIC Financial shall not exceed RMB5.5 billion during the effective term of this framework agreement. As a result of the acquisition of certain clean energy companies, the Company entered into a supplemental agreement to the financial services framework agreement with SPIC Financial in August 2023 to revise the original annual cap in respect of the maximum daily balance of deposit placed by the Group with SPIC Financial from RMB5.5 billion to RMB9 billion, while other principal terms remained unchanged.

In May 2025, the Company entered into a new financial services framework agreement (the “New Financial Services Framework Agreement”) to continue to engage SPIC Financial for the provision of financial services for a term of three years from 7 June 2025 to 6 June 2028. Pursuant to the New Financial Services Framework Agreement, the annual cap in respect of the maximum daily balance of deposit (including accrued interests) placed by the Group with SPIC Financial will increase from RMB9 billion to RMB12 billion during the effective term of this new agreement. The increase in the annual cap is intended to accommodate the new project companies arising from expected consolidation under the Proposed Asset Pre-Restructuring, the anticipated completion of the acquisition of Yuanda Environmental under the Proposed Asset Restructuring, and to provide a buffer for the potential issuance of financial instruments to support the Group’s organic growth and future acquisitions. For details, please refer to the circular of the Company dated 21 May 2025.

For the period between 1 January 2025 and 30 June 2025, the maximum daily balance of deposit (including accrued interests) placed by the Group with SPIC Financial was approximately RMB7.55 billion (31 December 2024: RMB8.99 billion), which did not exceed the cap.

Pursuant to the aforementioned financial services framework agreements, SPIC Financial provides the Group with an internal treasury management platform, a cross-border fund allocation platform and other financial services through its own financial resources, including the business information system and cross-border fund allocation channels. These platforms enable real-time monitoring of account balances, as well as income and expenditure, thereby safeguarding against funding risks. At the same time, they facilitate flexible and efficient fund allocation across borders, which gives rise to more flexible capital flow at home and abroad, broadens financing channels for domestic subsidiaries and reduces uncertainties in inbound and outbound capital flows due to changes in foreign exchange regulatory policies.

During the period under review, the Group recorded a net increase in cash and cash equivalents of RMB2,811,485,000 (2024: net increase of RMB527,712,000). For the six months ended 30 June 2025:

net cash generated from operating activities amounted to RMB7,471,217,000 (2024: RMB5,422,743,000). The increase was primarily due to the year-on-year decrease in cash outflow for coal procurement.

net cash used in investing activities amounted to RMB9,487,243,000 (2024: RMB14,055,098,000). The decrease was primarily due to a one-off payment made in 2024 to settle the remaining consideration for the acquisition of certain clean energy companies in October 2023, as well as a year-on-year reduction in payments for property, plant and equipment, and right-of-use assets, and prepayments for construction of power plants.

net cash generated from financing activities amounted to RMB4,827,511,000 (2024: RMB9,160,067,000). The decrease was primarily due to a year-on-year increase in repayments of borrowings from related parties.

The financial resources of the Group were mainly derived from cash inflow generated from operating activities, debt instruments, borrowings from banks and related parties, and project financing.

As at 30 June 2025, total debts of the Group amounted to RMB204,772,035,000 (31 December 2024: RMB197,360,970,000). Over 99% of the Group’s total debts are denominated in RMB.

As at 30 June 2025, the Group’s gearing ratio, calculated as net debt (being total debts less cash and cash equivalents) divided by total capital (being total equity plus net debt), was approximately 63% (31 December 2024: approximately 64%). The Group’s gearing ratio remained stable.

As at 30 June 2025, the amount of borrowings granted by SPIC Financial was approximately RMB11.15 billion (31 December 2024: approximately RMB11.03 billion).

When there is any indication of asset impairment, the Group will conduct an impairment test on the assets to assess whether an impairment has occurred.

In the first half of 2025, the Group recognized an impairment of property, plant and equipment totaling RMB316,000 (2024: RMB81,622,000). The impairment was primarily due to the fully written-off of preliminary expenses for a wind power project, as the project ceased to proceed.

In 2023, the Company was approved by the National Association of Financial Market Institutional Investors (“NAFMII”,中國銀行間市場交易商協會) to extend the effective registration period of issuing debt financing instruments (“DFI”) for further two years from September 2023. During the effective registration period, the Company is permitted to issue multi-type of DFIs, including but not limited to super & short-term commercial papers, short-term commercial papers, medium-term notes, perpetual notes, asset-backed notes and green debt financing instruments in one or multiple tranches.

Under the DFI registration, the Company issued (i) the first tranche of medium-term note in a principal amount of RMB2 billion at the interest rate of 1.86% per annum and a maturity period of 3 years; (ii) the second tranche of medium-term note in a principal amount of RMB2 billion at the interest rate of 1.70% per annum and a maturity period of 3 years; and (iii) the third tranche of medium-term note in a principal amount of RMB2 billion at the interest rate of 1.82% per annum and a maturity period of 3 years, on 11 June 2025, 17 June 2025 and 16 July 2025, respectively, in the PRC.

Wu Ling Power has obtained a “Notification on Acceptance of Registration” from the NAFMII, confirming the acceptance of its application for issuance of asset guaranteed debt financing instrument (the “Sci-Tech Note”, 資產擔保債務融資工具(科創票據)) in the PRC by tranches in an aggregate amount of RMB1 billion with an effective registration period of two years from August 2024. On 26 February 2025, Wu Ling Power issued its 2025-first-tranche of the Sci-Tech Note, with a principal amount of RMB400 million, an interest rate of 1.90% per annum, and a maturity period of 240 days to repay its maturing debt.

The proceeds from the above debt instruments have been fully applied towards the repayment of the existing borrowings.

The Company adopted a share incentive scheme (the “Share Incentive Scheme”) upon the approval by its shareholders at an extraordinary general meeting held on 15 June 2022. Under the Share Incentive Scheme, the Company granted a total of 103,180,000 share options in two tranches in July 2022. All the aforesaid grantees were employees of the Company or its controlled subsidiaries. As at 1 January 2025, there were 58,665,200 shares options granted but not yet lapsed or canceled. There were 5,822,300 share options lapsed during the period under review. Consequently, the Company had 52,842,900 share options outstanding under the Share Incentive Scheme as at 30 June 2025. Taking into account the leaving of grantees and based on the revised estimates of the number of share options that will lapse in the future, the Company recognized share-based payment expenses of RMB4,656,000 (2024: RMB11,523,000) during the period under review.

For the first half of 2025, the capital expenditure of the Group was RMB8,748,761,000 (2024: RMB11,496,469,000). In particular, the capital expenditure for clean energy segments (hydropower, wind power, photovoltaic power and energy storage) was RMB8,172,126,000 (2024: RMB9,776,142,000), which was mainly applied for the engineering construction of new power plants and power stations, and the asset purchases related to the energy storage business; whereas the capital expenditure for thermal power segment was RMB440,715,000 (2024: RMB1,513,946,000), which was mainly applied for the engineering construction of new power generating units and technical upgrade for the existing power generating units. These expenditures were mainly funded by project financing, debt instruments, funds generated from business operations and borrowings from related parties.

As at 30 June 2025, certain bank borrowings, borrowings from related parties and other borrowings totaling RMB1,336,771,000 (31 December 2024: RMB1,546,617,000) were secured by certain property, plant and equipment and right-of-use assets with a net book value of totaling RMB355,561,000 (31 December 2024: RMB632,581,000). In addition, certain bank borrowings, other borrowings and lease liabilities totaling RMB34,784,941,000 (31 December 2024: RMB31,911,780,000) were secured by the rights on certain accounts receivable amounted to RMB12,094,270,000 (31 December 2024: RMB9,576,998,000).

As at 30 June 2025, the Group had no material contingent liabilities.

In February 2025, the NDRC and the NEA jointly issued Circular No. 136. Circular No. 136 specifies that, in principle, all the on-grid electricity for new energy projects shall enter the electricity spot market and that on-grid tariff shall be derived through market transactions. Circular No. 136 takes 1 June 2025 as the turning point to divide existing and newly added projects, and establishes the “mechanism-based tariff” as the threshold warranty, so as to achieve a seamless integration for the entry of the existing new energy projects into the market at this stage. For the existing new energy projects that commenced production before 1 June 2025, the mechanism-based tariff shall be implemented at a certain percentage of the electricity generated and based on the benchmark tariff for coal-fired power, and the price difference shall be settled. For newly added projects that commenced production after 1 June 2025, the proportion of electricity to be included in the mechanism will be dynamically adjusted, and the mechanism-based tariff will be derived according to the bidding process of newly commissioned projects.

In addition to allowing the entry of new energy into the market under Circular No. 136, the NDRC and the NEA jointly issued the “Circular on Comprehensively Accelerating the Development of the Electricity Spot Market” (“Circular No. 394”) in April 2025, which requires that the full coverage of the electricity spot market be basically realized on a national basis by the end of 2025, and that continuous settlement be carried out comprehensively, giving full play to the key role of the spot market in identifying prices and regulating the supply and demand. The significance of Circular No. 394 lies in, among others, once again recognizing the distinctive role of the electricity spot market in optimizing resource allocation, procuring safe power supply, and promoting the renewable energy consumption. It once again clarifies the timetable for the establishment of the spot market for electricity trading, and urges the speedy development of spot markets in certain provinces.

In April and May 2025, the NDRC and the NEA jointly issued the “Guiding Opinions on Accelerating the Development of Virtual Power Plants” and the “Circular on Organizing and Carrying Out the First Batch of Pilot Work for the Construction of New-type Power Systems”, proposing to accelerate the comprehensive participation of virtual power plants in the medium-to-long-term power markets and spot market transactions as a new type of resource aggregation business entity and clarify the corresponding principles for calculating electricity volumes and electricity charges. The participation of virtual power plant in power sale and purchase business in the medium-to-long-term power market as well as spot market can help to enhance the price formation mechanism in the medium-to-long-term power market, and appropriately expand the price limit range in the spot market.

With the full roll-out of the spot market for electricity trading and the comprehensive entry of new energy, coupled with the rush to install new capacity in the first half of the year triggered by Circular No. 136, as well as the coal-fired power generating units of approximately 260 million kW approved nationwide between 2022 and 2024 that are expected to be put into operation gradually from 2025 to 2026, the tight supply and demand tie in the national power market is expected to be eased. This change will impose a drag on spot prices. Against this backdrop, new energy projects, particularly newly added projects, face the possible annual adjustments to their mechanism-based power tariff and electricity volume, which could result in continual changes in and impacts on their revenues. However, market-based transactions will adjust users’ power consumption habits through the price mechanism, delivering apparent price signals to users, encouraging them to purchase green power and promoting the consumption of new energy, while providing them guidance on adjusting their loads. The downward trend of spot prices will guide the movements of medium- and long-term transactions. In terms of annual medium-to-long-term transactions, as hedging instruments with “locked volume and price”, it should endeavor to increase the traded power volume while raising the prices as high as possible, in order to address the challenges posed by the downward trend of spot prices in the market. On the other hand, virtual power plants balance the supply and demand of the power system through a strategy of purchasing low and selling high, which will present new opportunities for power sales.

The Group will strengthen the review of the market conditions and the analysis of economic activities, closely monitor key indicators such as electricity volume and tariff, and optimize the priority and structure of power generation to strive for opportunities in generating electricity and promote power sales. In addition, the Group will also continue to optimize various types of power sources to flexibly respond to the changing market environment.

| Address | Suite 6301, 63/F, Central Plaza, 18 Harbour Road, Wanchai, Hong Kong |

| Phone | (852) 2802-3861 |

| Fax | (852) 2802-3922 |

| ir@chinapower.hk |