Governance Framework

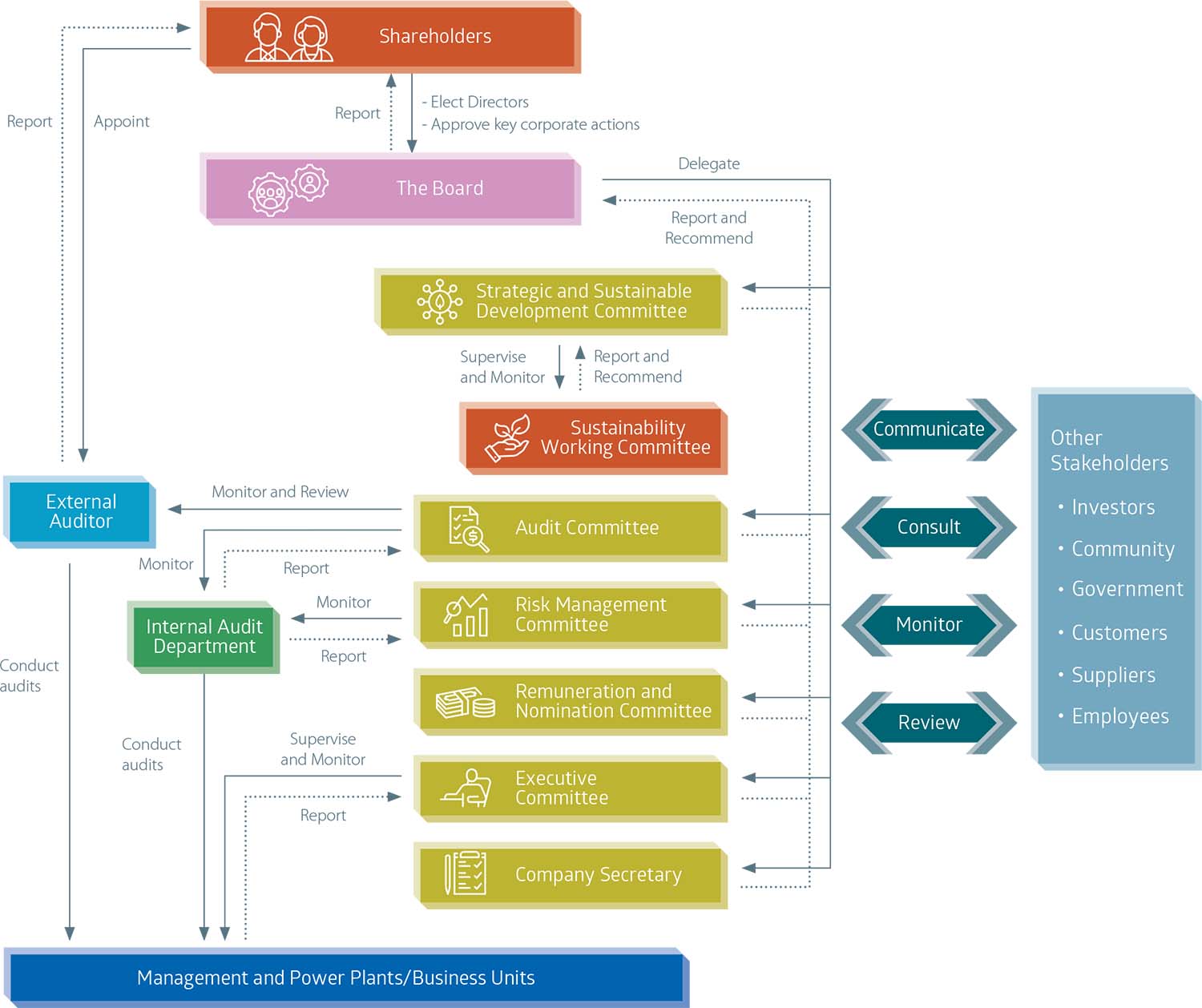

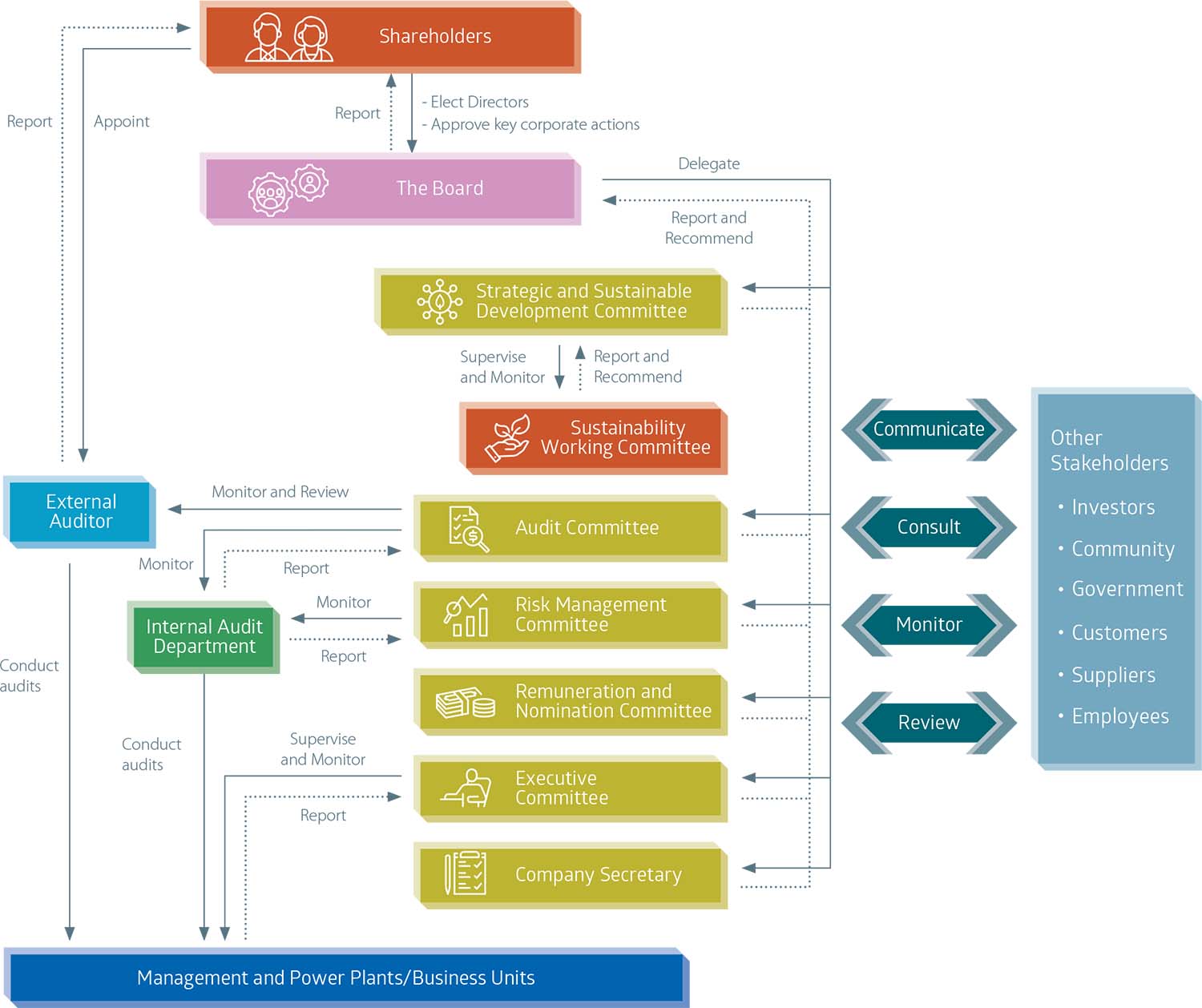

Set out below is our corporate governance framework:

The Board

Board Composition

As at the date of this annual report, the Board comprises a total of nine Directors, as follows:

| Executive Director |

Non-executive Directors |

Independent Non-executive Directors |

| Mr. HE Xi (Chairman of the Board) |

Mr. HU Jiandong |

Mr. LI Fang |

Mr. GAO Ping (President, the chief

executive of the Company) |

Mr. ZHOU Jie |

Mr. YAU Ka Chi |

|

Ms. HUANG Qinghua |

Mr. HUI Hon Chung, Stanley |

|

Mr. CHEN Pengjun |

|

Profiles, roles and functions of the Directors are set out in the section headed “Directors and Senior Management Profiles” in this annual report, and the latest list of Directors and their respective role and function are also published on the websites of the Company and the Hong Kong Stock Exchange.

The Company appointed two experienced Directors, Mr. HU Jiandong and Mr. CHEN Pengjun, to join the Board in November 2024, aiming to enhance the skill diversity of the Board. With their appointment as non-executive Directors, the current Board composition reflects a more diverse mix of experience, gender, capabilities, skills and expertise in different fields that are suitable for and relevant to the Company’s businesses. Please refer to the “Board Skills Matrix” set out below.

Board Independence

Pursuant to Rules 3.10 and 3.10A of the Listing Rules, the board of directors of a listed issuer is required to have a minimum of three independent non-executive directors, and of which the independent non-executive directors must account for at least one-third of the total number of the board members. In compliance with the relevant requirements, the Company’s board of directors currently has seven non-executive directors (including three independent non-executive directors) with the number of independent non-executive directors accounting for one-third of our Board members. They are assisting the Board to make more effective independent judgment, to make decisions in an objective and professional manner, and to assist the management in formulating the Company’s development strategies. Additionally, they ensure that the preparation of financial and other mandatory reports by the Board are compiled strictly in accordance with relevant regulations and standards in order to protect the interests of the shareholders and the Company as a whole.

Both the Audit Committee and the Remuneration and Nomination Committee comprise all independent non-executive Directors, and both committees are chaired by an independent non-executive Director. Independent non-executive Directors are entitled to directors’ fees reflecting their membership of the Board committees and additional fees for attendance of meetings. None of these Directors receives remuneration based on performance of the Group, and none of them are entitled to any incentive scheme of the Group.

The Company has confirmed with each of the independent non-executive Directors if there is any subsequent change of circumstances which may affect their independence as regards to each of the factors referred to under Rule 3.13 of the Listing Rules during the year. Each of the independent non-executive Directors has provided written confirmation to the Company confirming that there has been no matter needs to be brought to the attention of the Company and the Hong Kong Stock Exchange which may affect their independence. Having regard to the confirmation as well as the actual contribution that each of the independent non-executive Directors has made, the Board concluded that each of the independent non-executive Directors to be independent.

The Company has a vigorous nomination policy for selection, appointment and re-election procedures and process for Directors. There is no relationship (including financial, business, family or other material/relevant relationship) between the board members, or between the Chairman of the Board and the President (chief executive) of the Company.

The Board has put in place a mechanism for Directors to seek additional independent professional advice in the discharge of their duties to ensure that independent views and inputs are available to the Board.

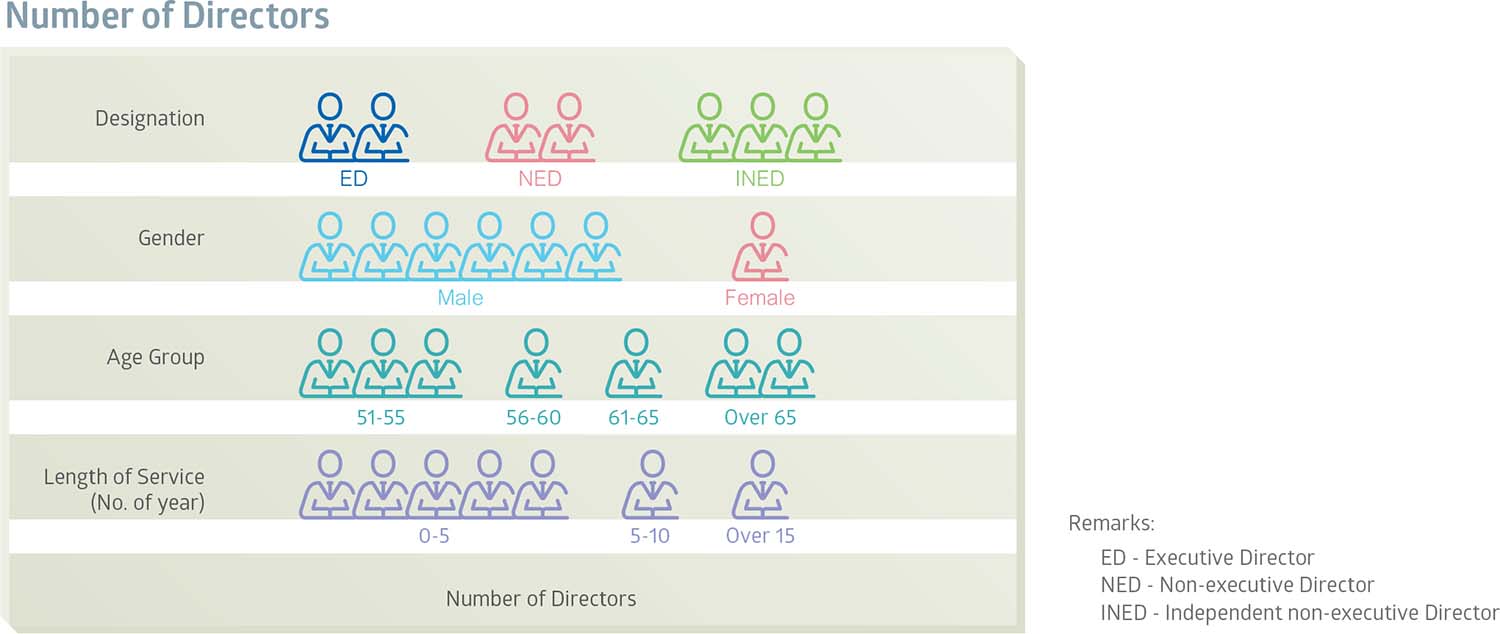

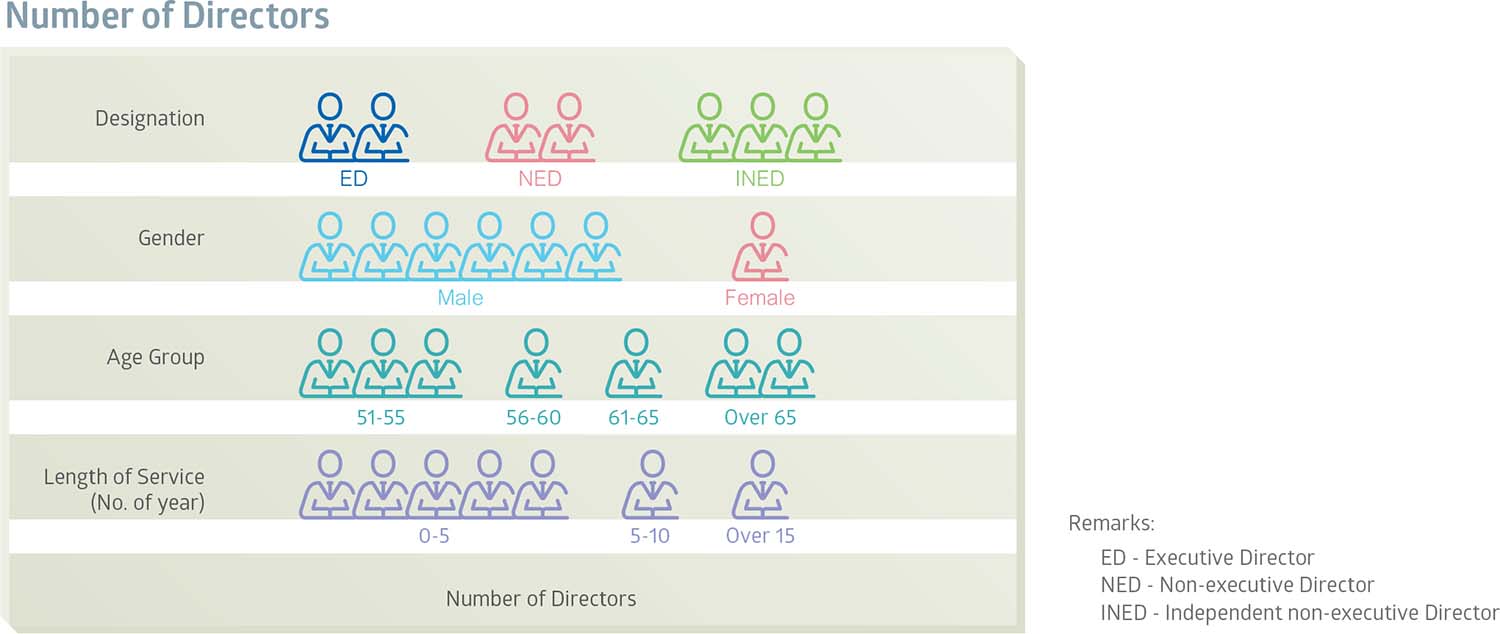

Board Diversity

The Company acknowledges that gender and other aspects of diversity are important drivers of the Board’s effectiveness that is positively associated with the financial performance of the Company, more effective decision making and better risk management. The Board is satisfied that all present Directors are well experienced and having progressive thinking in leading the Group.

The Board adopted a Board Diversity Policy in August 2013 and reviewed the implementation and effectiveness of the policy annually. As to gender diversity of the Board, the initial target of appointing at least one female director was achieved in 2023. It is the intention of the Board to increase the female director ratio to 30% by 2030. The Remuneration and Nomination Committee has adopted measures to ensure the appropriate gender diversity mix of the Board.

The Board Diversity Policy of the Company is summarized as follows:

for identifying suitably qualified candidates to become Board members, it should be based on a number of diverse aspects, including Board members with different background, skills, regional and industry experience, gender and other qualities, that are in balanced and complementary with each other, creating synergy, and enabling the Board to function effectively as a whole.

when reviewing and assessing the composition of the Board, it should be based on the Company’s own business position and management needs from time to time, considering a number of factors, including but not limited to, the above-mentioned background, skills, regional and industry experience, and other factors in order to achieve a reasonable structure that allows the Board to function efficiently.

The Board Diversity Policy is reviewed periodically to ensure it remains in-line with the Company’s culture and values.

The diversity mix of the Board is summarized in the following chart:

Board Skills Matrix

The table below sets out the diverse mix of skills and expertise of the Board that are most relevant to Company’s strategy, governance and business and to enabling the Board to effectively discharge its duties and responsibilities in attaining its strategic objectives and achieving sustainable and balanced development for the Group.

Board’s Role

The Board is the highest decision-making and managing body of the Company. Having regard to the best interests of the Company and its shareholders, the Board provides leadership and guidance to the Group’s activities. The Board, led by the Chairman, is responsible for, among other things:

promoting the Group’s long-term sustainable development and success, thus delivering value to shareholders;

establishing and approving strategies and objectives of the Group and ensuring that they align with the Company’s culture and values;

approving and monitoring business plans for achieving the Group’s objectives;

approving major investments, mergers and acquisitions, and other material transactions;

overseeing the Group’s risk management and internal control systems;

overseeing the Group’s corporate governance arrangements;

overseeing the Group’s ESG strategies and development;

supervising and administrating the operation and financial position of the Group;

approving result announcements, periodic reports and other disclosures as required in accordance with applicable laws and regulations and the Listing Rules;

approving appointment of Directors and senior management personnel; and

promoting engagement with shareholders of the Company and other stakeholders.

Directly under the Board, there are Board committees that are specifically formed to carry out the above different functions.

Board Committees

At present, there are five committees under the Board, namely (1) Audit Committee, (2) Risk Management Committee, (3) Remuneration and Nomination Committee; (4) Strategic and Sustainable Development Committee; and (5) Executive Committee to implement internal supervision and control on each relevant aspects of the Group. In addition, the Sustainability Working Committee is a sub-committee of the Strategic and Sustainable Development Committee established to assist with the formulation and implementation of sustainability-related policies of the Group.

For further information on the Board committees and their work done in 2024, please refer to the separate reports from each of the Board committees set out in this annual report.

Board Evaluation

The Company acknowledges that regular Board performance evaluations can help building a high-performing Board, which is equipped with the necessary capabilities to anticipate, prepare for and overcome future challenges.

The Board concurs that board evaluation is useful to enhance Directors’ accountability and provide valuable feedback for improving Board effectiveness, maximizing strengths, highlighting areas for further development and evaluating whether the Board is adhering to the Company’s culture and values.

The Board and its committees are committed to regular evaluation of their effectiveness annually, thus to ensure that the Board and management are on the same page, and that the Board, being the prominent authority of the Company, its performance is actually leading the Company on the right track towards its long-term goals

For year 2024, the Board performance evaluation took the form of a questionnaire, which was prepared by the Company Secretary, with inputs from third party stakeholders. The content of the questionnaire will be refined from time to time to ensure that the questions are relevant to the present socioeconomic environment, as well as reflecting on issues identified in previous performance evaluations.

The questionnaire covered the following key areas:

Role, Responsibility and Operation of the Board;

Composition of the Board and Governance Structure;

Function of Board committees;

Conduct and Procedures of Board Meetings; and

Assessment on ESG governance.

Based on the feedback from the Directors, the Board evaluation revealed that they considered and were satisfied with the Board’s performance in the following aspects, including

| (i) |

leading the Company towards meeting its strategic goals;

|

| (ii) |

practices in compliance with the CG Code, the Listing Rules and other laws, rules and regulations applicable to the Company;

|

| (iii) |

a right mix of talents inside the Board (skills, experience and competencies etc.);

|

| (iv) |

functioning of the existing Board committees in assisting the Board with governance of the Company;

|

| (v) |

identification, discussion, and resolution of key issues of the Group;

|

| (vi) |

effective communication between the Board and the management of local business units; and

|

| (vii) |

keeping up with current knowledge of the Group’s key new business segments and their development.

|

The Board evaluation also identified a number of issues that require improvement to enhance the effectiveness of the Board, including (i) gender diversity of the Remuneration and Nomination Committee; (ii) communication with independent external professional advisory parties for decision-making; (iii) communication with the shareholders and market participants on dissemination of corporate information; and (iv) comparison with other companies in the same industry on ESG governance. As discussed with the Board, the Directors have made constructive suggestions to the management, summarized as follows:

| |

Findings from the evaluation

|

Recommendations for action |

| 1 |

Improving gender diversity of the Remuneration and Nomination Committee which is currently comprised members of solely male Directors. |

To appoint a female Director to serve as a member of the Remuneration and Nomination Committee in 2025 , as required under the proposed amendments to the CG Code that will be effective from 1 July 2025. |

| 2 |

Timely communication with independent external professional advisory parties on key corporate transactions for sound decision-making. |

To arrange independent external professional advisory parties (e.g. auditors, lawyers, valuers and financial advisors) to attend meetings with the Board in order to give sufficient understanding and attention to risks, challenges, regulatory compliance and other major issues arising from key corporate transactions in a timely manner. |

| 3 |

Direct communication with the shareholders and market participants on dissemination of corporate information. |

To arrange more frequent meetings with shareholders and market participants for better information transparency in terms of understanding the Company’s operations, corporate decisions and ESG practices so as to strengthen investors’ confidence. |

| 4 |

Benchmarking comparison with other companies in the same industry on ESG governance. |

To prepare annual performance comparison of comparable listed companies engaging in power and energy sector on ESG governance, and serve to benchmark our own performance with the industry level and strive to enhance our own standards above the average. |

At the same time, all independent non-executive Directors have reviewed the performance of the Chairman of the Board and were satisfied with his performance.

Taken into consideration of the above recommendations, the Directors and together with the management have committed to take appropriate actions to further improve the Board’s effectiveness.

DIRECTORS’ APPOINTMENT, RESPONSIBILITIES, DELEGATION AND RELEVANT PROCEEDINGS

Appointment and Rotation of Directors

In accordance with the Company’s articles of association, one-third of the Directors (including non-executive Directors with fixed term of three years) shall retire from office by rotation and be re-elected by shareholders at the annual general meetings. In addition, any new appointment to the Board is subject to re-appointment by shareholders at the upcoming general meeting. Every Director (including non-executive Directors), whether or not appointed for a specific term, should be subject to retirement by rotation at least once every three years.

If an independent non-executive Director serves more than nine years, his/her further appointment should be subject to a separate resolution to be approved by shareholders. The documents attached to shareholders accompanying that resolution should include the process used for identifying the individual and why the Board believes the individual should be elected and the reasons why it considers the individual to be independent. If the proposed independent non-executive director will be holding their seventh (or more) listed company directorship, why the Board believes the individual would still be able to devote sufficient time to the Board; the perspectives, skills and experience that the individual can bring the Board; and how the individual contributes to diversity of the Board.

The Company has in place a Nomination Policy setting out the selection and recommendation criteria and the appropriate procedures to be adopted when considering nomination and appointment of suitable candidates for directorship to the Board. Please refer to the section headed “Nomination Policy” in the Remuneration and Nomination Committee Report in this annual report.

Directors Induction

Every newly appointed Directors will receive a comprehensive, formal and tailored induction on the first occasion of his/her appointment, so as to ensure that he/she has a proper understanding of the operations and business of the Company, and he/ she is fully aware of his/her responsibilities under the Hong Kong Companies Ordinance and Common Law, the Listing Rules, the applicable rules and other regulatory requirements, and especially the governance policies of the Company.

All Directors are required to disclose to the Company their offices held in public companies or organizations and other significant commitments. Every Director should ensure that he/she can give sufficient time and attention to the Company’s affairs, and make contributions to the Company that commensurate with their role and responsibilities.

All Directors have been given the Guidelines on Directors’ Duties and Working Guidelines for the Board of the Company and various guides for directors published by the Hong Kong Stock Exchange and Securities and Futures Commission. The Company Secretary continuously updates and keeps the Directors apprised on the latest laws, rules and regulations regarding their duties and responsibilities.

Directors’ Continuous Development

Directors’ training is an ongoing process to ensure that their contribution to the Board remains informed and relevant. The Company encourages all Directors to participate in appropriate training programs to develop and refresh their knowledge and skills. During the year under review, all members of the Board have provided their records of training to the Company Secretary for record. Their trainings included attending seminars, webinars and discussion forums, reading briefings and updated materials on specific topics including current legislative rules and regulations, directors’ responsibilities, corporate governance and ESG matters, updates on power industry developments, etc.

Directors’ Securities Transactions

The Company has adopted a set of Code of Conduct for Securities Transactions by Directors (“Code of Conduct”), the terms of which are not less exacting than the Model Code for Securities Transactions by Directors of Listed Issuers as set out in Appendix C3 to the Listing Rules. Having made specific inquiries to all Directors, all Directors confirmed that they have complied with the Code of Conduct throughout the year 2024.

Directors’ Insurance

The Company has arranged appropriate insurance cover on Directors’ and officers’ liabilities in respect of legal actions against its Directors and senior management arising out of corporate activities.

Chairman and President (chief executive)

The division of responsibilities between the Chairman and the President (chief executive) has been clearly established and set out in writing. Under C.2.1 of the CG Code, the role of the chairman and the chief executive should be separate to ensure a balance of power and authority. During the year ended 31 December 2024, the Company strictly complied with C.2.1 of the CG Code. The roles of the Chairman and the President of the Company are separate and are currently assumed by Mr. HE Xi and Mr. GAO Ping, respectively.

Chairman

The Chairman provides leadership for the Board and is responsible for ensuring that all Directors promptly receive adequate information, which must be complete and reliable, and that Directors are properly briefed on issues arising at the Board meetings. He affirms the Board is working effectively and discharging its responsibilities. He also ensures good corporate governance practices and procedures are established, and appropriate steps are taken to provide effective communication with shareholders and those views of shareholders are communicated to the Board.

The Chairman encourages all Directors to make a full and active contribution to the Board’s affairs and take the lead to ensure that it acts in the best interests of the Company. He encourages Directors with different views to voice their concerns, allow sufficient time for discussion of issues and ensure that Board decisions fairly reflect the Board consensus. He promotes a culture of openness and debate by facilitating the effective contribution of non-executive Directors in particular and ensuring constructive relations between executive and non-executive Directors.

President (chief executive)

The President is the chief executive of the Company who has delegated authority from and is accountable to the Board. The President is responsible for managing the Group’s business, implementation of strategies, initiatives and directives set by the Board and coordinating overall business plans and budgets approved by the Board and making day-to-day operational decisions.

Delegation by the Board

The Board delegates certain management and operational functions to the Executive Committee and the management, and reviews such arrangements periodically to ensure that they remain appropriate to the Group’s needs.

The management has overall responsibility for the Group’s daily operations. The Board has established clear responsibilities and authorities for management to ensure daily operational efficiency. It acts within the authority approved by the Board to fulfill the day-to-day management responsibilities and makes timely decisions. With regard to matters beyond its authority, the management will report to the Executive Committee or the Board in a timely manner in accordance with the relevant working guidelines.

Conduct of Board Proceedings and Supply of and Access to Information

Throughout the year under review, arrangements were in place to ensure all Directors were given an opportunity to include matters in the agenda for regular Board meetings. Notice of at least fourteen days was given for a regular Board meeting to give all Directors an opportunity to attend. For all other Board meetings, reasonable notice was also given.

Full Board or committee papers were sent to all Directors at least three days before the intended date of a Board meeting or a committee meeting. Management had supplied the Board and its committees with adequate information and explanations so as to enable them to make an informed assessment of the financial and other information put before the Board and its committees for approval. Management was also invited to join the Board or Board committee meetings where appropriate.

For meetings of the Board, if a Director has a conflict of interest in a matter to be considered by the Board which the Board has determined to be material, the matter must be dealt with by a physical Board meeting rather than a written resolution. Independent non-executive Directors who, and whose close associates, have no material interest in the transaction shall be present at that Board meeting. Any Director who has a conflict of interest must abstain from voting.

During the year under review, minutes of the Board meetings and meetings of Board committees were recorded in detail the matters considered and decisions reached at the meetings. Draft and final versions of minutes were sent to all Directors for their comments within a reasonable time after the Board or Board committee meetings were held. Minutes of the meetings are always kept by our Company Secretary, and the Board and committee members may inspect the documents and minutes of the Board and Board committees at any reasonable time by giving reasonable notice.

At all time, where necessary, the Directors can seek separate independent professional advice at the Company’s expenses so as to discharge his/her duties to the Company. All the Directors are also entitled to have access to timely information in relation to our business and make further enquiries where necessary, and they have separate and independent access to senior management of the Company.

BOARD AND BOARD COMMITTEES’ MEETINGS

The following table sets out the meetings held in 2024.

Board

B: Board

C: Chairman and all independent non-executive Directors

I: All independent non-executive Directors attended the meeting. Management was invited to provide a briefing on a

specific topic or transaction.

N: All non-executive Directors and independent non-executive Directors attended the meeting. Management was invited

to provide a briefing on a specific topic or transaction.

AGM: Annual General Meeting

Board Committees

AC: Audit Committee

RNC: Remuneration and Nomination Committee

RMC: Risk Management Committee

SSDC: Strategic and Sustainable Development Committee

In addition to the above Board and Board Committees’ meetings, three symposiums for non-executive Directors and independent non-executive Directors were held during the year 2024. One symposium aimed to foster open dialogue with the local management of a key business segment of the Group, while the other two focused on updating independent non-executive Directors about the current developments in the power industry in the PRC. Attendance at these symposiums was entirely optional; however, participation was high, and the feedback from the non-executive Directors and independent non-executive Directors was positive.

DIRECTORS’ ATTENDANCE RECORD

The attendance records of the Directors at Board meetings, Board committees’ meetings and shareholders’ meetings are as

follows:

| Directors |

Board |

Audit Committee |

Risk Management Committee |

Remuneration and Nomination Committee |

Strategic and Sustainable Development Committee |

Annual General Meeting |

| Executive Directors: |

|

|

|

|

|

|

| HE Xi (Chairman of the Board, Risk Management Committee and Strategic and Sustainable Development Committee) |

9/9 |

– |

2/2 |

– |

3/3 |

1/1 |

| GAO Ping (President and chief executive) |

7/8 |

– |

2/2 |

– |

2/3 |

1/1 |

| |

|

|

|

|

|

|

| Non-executive Directors: |

|

|

|

|

|

|

| HU Jiandong(1) |

2/2 |

– |

– |

– |

– |

– |

| ZHOU Jie |

10/10 |

– |

– |

|

3/3 |

1/1 |

| HUANG Qinghua |

9/10 |

– |

– |

– |

– |

1/1 |

| CHEN Pengjun(1) |

1/2 |

– |

– |

– |

– |

– |

| |

|

|

|

|

|

|

Independent

Non-executive Directors: |

|

|

|

|

|

|

| LI Fang (Chairman of the Remuneration and Nomination Committee) |

13/13 |

2/2 |

2/2 |

2/2 |

3/3 |

1/1 |

| YAU Ka Chi (Chairman of the Audit Committee) |

13/13 |

2/2 |

2/2 |

2/2 |

3/3 |

1/1 |

| HUI Hon Chung, Stanley |

12/13 |

2/2 |

2/2 |

2/2 |

– |

1/1 |

Notes:

(1) Mr. HU Jiandong and Mr. CHEN Pengjun were appointed as non-executive Directors with effect from 18 November 2024.

Executive Committee

The Company established the Executive Committee in 2008. As a committee under the Board, the Executive Committee conducts its work under the guidance of the Board and reports to the Board pursuant to the “Working Guidelines for the Executive Committee” approved by the Board. The chairman of the Executive Committee is served by Mr. HE Xi, the executive Director and the Chairman of the Board. The members of the committee include the executive Directors and all the vice presidents of the Company. It has been delegated with the responsibilities to ensure the effective direction and control of the business and to deliver the Group’s long-term strategies and goals. It advises the Board in formulating policies in relation to the Group’s business operations, monitors the performance and compliance issues of the business, and supervises the management to implement the Board resolutions.

The Executive Committee acts as a bridge for communication and connection between the Board and the management, and plays a crucial role in enhancing the quality of corporate governance as well as strengthening the management efficiency of the Group. It ensures that the Board can timely hear the voices of the operation and management staff and acts timely in respect of material operation affairs of the Group. It meets on a regular basis to review the Group’s activities and discuss management and operational issues.

The Executive Committee held 28 meetings during 2024 . The executive Directors, the vice presidents and the senior management of the Company attended the meetings.

Company Secretary

Ms. CHEUNG Siu Lan, secretary of the Company, is an employee of the Company, appointed by the Board, and responsible to the Board. The Company Secretary is responsible for ensuring that the activities of the Board are conducted efficiently and effectively, and the procedures and all applicable laws and regulations are followed. She also supports and facilitates the training and professional development of Directors.

The Company Secretary reports to the Chairman and the Board, provides advice on corporate governance and corporate transactions, and assists the Board in discharging its obligations to shareholders pursuant to the Listing Rules. All Directors may call upon her for advice and assistance at any time in respect to their duties and the effective operation of the Board and the Board committees.

During the year under review, Ms. CHEUNG has attended relevant professional seminars/webinars to update her skills and knowledge. She has complied with the Listing Rules to take no less than 15 hours of relevant professional training in a financial year.

Environmental, Social and Governance

The Board recognizes the growing importance of ESG with the market, shareholders, investors and stakeholders placing increased weighting on the ESG performance of a company. In light of this trend, the Board has decided that it should be proactive in the development and oversight of the Company’s ESG strategy.

The Company has established a comprehensive organizational structure for sustainable development, in which we count on the Sustainability Working Committee to carry out sustainable development matters of the Group, and to report to the Strategic and Sustainable Development Committee and the Board in a timely manner, thereby further promoting the Group’s practices for sustainable development.

The Group conducts climate risk assessment exercise with reference to the Task Force on Climate-related Financial Disclosures (“TCFD”), recommendations, identifying some of the most material physical and transitional risks, their implications and corresponding mitigation measures. We have been continuously monitoring and disclosing the environmental and climate-related metrics to facilitate a transparent communication with our stakeholders.

On 19 April 2024, the Hong Kong Stock Exchange released the Consultation Conclusions on the Enhancement of Climate-related Disclosures under the Environmental, Social, and Governance Framework. The new requirements align with IFRS S2 Climate-related Disclosures to the maximum extent possible. Issuers within the Hang Seng Composite Large Cap Index are required to disclose scope 3 greenhouse gas emissions on a mandatory basis, effective from 1 January 2025. For other issuers, disclosure will follow a comply-and-explain basis.

As one of the leading green and low-carbon energy providers in China, the Company is strongly committed to enhancing the extent and quality of its environmental disclosures. Efforts, including IT-support solutions and recruitment of experienced talents, are underway to improve our environmental reporting mechanism in order to meet the new disclosure requirements. Preliminary work has been conducted to map our value chain business activities against the 15 categories of greenhouse gas emissions outlined in the GHG Protocol’s Corporate Value Chain (Scope 3) Accounting and Reporting Standard. Additionally, the Group is leveraging both internal and external resources, including external consultants where applicable, for effectively complying with the new disclosure requirements in 2025.

During the year 2024, the Board had reviewed, discussed and approved the Sustainability Report 2023 of the Company as reported by the Strategic and Sustainable Development Committee. The Board had ensured all new investment and acquisitions approved last year were in line with the Company’s ESG strategy and ESG-related targets of the Company. The Board’s statement and its engagement in relation to the ESG matters of last year are set out in the Company’s Sustainability Report 2024.

For further information of our ESG strategy, governance approach, management of climate-related risks and progress towards our ESG-related targets, please refer to the full version of the Sustainability Report 2024 of the Company as published on the websites of the Company and the Hong Kong Stock Exchange.

AUDIT, INTERNAL CONTROL AND RISK MANAGEMENT

Financial Reporting

Directors acknowledge their responsibility for preparing the financial statements on a going concern basis, with supporting assumptions or qualifications as necessary. The Company’s financial statements are prepared in accordance with the Listing Rules, Hong Kong Companies Ordinance and also the accounting principles and practices generally accepted in Hong Kong. Appropriate accounting policies are selected and applied consistently; judgments and estimates made are prudent and reasonable.

During the year 2024, all Directors have been given the latest information and briefings about the financial position, changes in the business and the development of the Group on a regular basis. “Letter to the Shareholders” from the Chairman of the Board in this annual report contains a summary of the Group’s performance in this financial year and how the Group will preserve value over the long term and our strategies for delivering the Company’s objectives. The Directors ensured a balanced, clear and understandable assessment of the Group’s performance, position and prospects in annual reports, interim reports, inside information announcements and other disclosures required under the Listing Rules and other statutory requirements.

Risk Management and Internal Control Systems

The Board puts particular emphasis on risk management and strengthening internal control system. In respect of organizational structure, the Company has set up the Strategic and Sustainable Development Committee, the Audit Committee, the Risk Management Committee, the Remuneration and Nomination Committee and the Executive Committee, and there is also a Sustainability Working Committee under the Strategic and Sustainable Development Committee. The principles of the internal control framework of the Company are to strengthen the Company’s internal monitoring and control in accordance with the requirements of the Hong Kong Stock Exchange, continuously improve the Company’s corporate governance structure, build up corporate integrity culture, establish an effective control system, continuously assess the competence of the internal control system and the efficiency of the management through auditing, risk assessments and internal assessments, review identified risk exposures and ensure the effective running of the control system.

The Company has established an Internal Audit Department that has been ensuring the independence of its organization, staffing and work, which is crucial to the Company’s internal controls. In order to actively create a sound internal control environment, the Internal Audit Department provides internal control assessment reports to the management on a regular as well as ad hoc basis. It also reports to the Audit Committee, the Risk Management Committee and the Board at least twice a year on internal control and risk management matters. To minimize risks faced by the Company, the Internal Audit Department evaluates and reviews the Company’s internal control processes to avoid risks and provide a solid foundation for building up an effective internal control system.

The Company has also established an Audit Center with the objectives of standardizing and information-digitalizing internal audit and risk management, the Audit Center provides systematic support to the internal audit and control team, and provides relevant personnel training for the development of the Group.

The Company has comprehensive internal control systems in place, including regulations such as the “Management Regulations for Internal Control”, “Rules for Management Authorization”, “Management Measures for Employees’ Rewards and Punishments”, “Management Measures for Conflicts of Interests”, “Standards for Internal Control”, “Risk Management Regulations” and “Working Measures for Internal Audit”.

While taking into full account the risk management framework requirements of The Committee of Sponsoring Organizations of the Treadway Commission (the “COSO”), the promoter of the National Commission on Fraudulent Financial Reporting, and risk management guidelines set out by the Hong Kong Institute of Certified Public Accountants, the internal control system of the Company also learns from the experience of outstanding management companies and takes into consideration our actual situation and business characteristics in formulating the control framework for assessing the efficiency and competence of the internal control system, which provide a reasonable assurance to ensure the effectiveness of the Company’s operating activities, reliability of its financial reports and compliance of laws and regulations.

Effectiveness of Risk Management and Internal Control Systems

The Board through the Audit Committee and Risk Management Committee has reviewed the efficiency of the internal control system of the Group in aspects such as financial controls, operational controls, regulatory compliance and risk management. The head of the Internal Audit Department provides the “Annual Confirmation of the Effectiveness of the Risk Management and Internal Control Systems”, which is counter-signed by the Risk Management Committee, to the Board. The Directors believe that the risk management and internal control systems are efficient and adequate, and controls the risks that might have impacts on the Company in achieving its goals effectively.

For the year ended 31 December 2024, the Company has strictly complied with the relevant provisions of the CG Code regarding risk management and internal control. During the year under review, our Internal Audit Department carried out major works in relevant respects, which included the following:

Comprehensive internal audit coverage

In respect of internal audit for the year, we formulated a comprehensive coverage plan. During the year under review, (i) we organized a total of 14 internal audits, covering such aspects as financial revenue and expenditure, construction projects and economic responsibilities, and conducted 1 special audit involving 195 new energy projects, in which we put forward various management advice and risk alerts to assist the relevant units to enhance their risk management standards; (ii) We also optimized the rectification supervision mechanism and established mechanisms for, among others, special meetings, on-site supervision and close tracking on key issues to ensure full utilization of the audit findings, and ensure general enforcement of the accountability for audit and rectification; and (iii) In addition, we promoted the application of the “digital and intelligent audit system” and reviewed the problems or risks raised by the audit model in a timely manner, thereby enhancing the quality and efficiency of audit.

Strengthening risk management continuously

In respect of risk management, we formulated a “company-specific policy” checklist for prevention and control of major risks to implement precise risk prevention and control measures. Meanwhile, we prepared and reviewed the risk assessment reports in strict compliance with the relevant requirements, ensuring that comprehensive and effective risk alerts are available for reference by decision makers. We also issued the job-specific risk management manual that closely integrates job responsibilities with risk prevention and control, encouraging our staff to take initiatives in ensuring risk prevention at work.

Enhancing internal control assessment

We carried out internal control assessment on the following special topics: (i) the risk and internal control and management and reorganization of the newly acquired companies; (ii) the corporate governance, decision-making process and internal control of the “coal-and-power joint-operation” companies, as well as the well-defined authorities and responsibilities of the joint ventures or cooperating partners; (iii) the establishment and implementation of internal control design system of the newly established companies; and (iv) the establishment and implementation of internal control mechanism in high-risk areas (e.g. investment management, fund management and procurement management, inclusive of transactions with connected parties).

Optimizing post-investment evaluation

During the year 2024, we carried out post-investment evaluation for 15 investment projects, deployed and promoted the rectification for evaluation findings and deficiencies, and set up ledgers for tracking the effectiveness of post-evaluation to improve the result reporting mechanism. In addition, we summarized the status of the audit findings for projects in 2023 and reported them to all subsidiaries and business units in the Group’s internal systems, so as to ensure the optimal use of the evaluation findings, and hence enhance the verification, decision-making, and internal control system development and operation standards for investment projects.

Reviewing the continuing connected transactions

The Internal Audit Department also established a docking mechanism for reporting on continuing connected transactions for major provincial subsidiaries that are newly consolidated into the Group and took appropriate measures to review the implementation of the Group’s existing continuing connected transactions on a quarterly basis. For the year ended 31 December 2024, each of the relevant companies of the Group had strictly monitored the agreed prices and terms of the various continuing connected transactions in the actual course of business operations, hence none of the transactions exceeded the relevant annual caps as disclosed.

Inside Information

The Company adopted its own Inside Information Management Policy setting out the procedures and internal controls for handling and dissemination of inside information in August 2013 with reference to the “Guidelines on Disclosure of Inside Information” issued by the Securities and Futures Commission in June 2012.

In response to evolving corporate governance standards and to ensure the proper management of sensitive information, the Company conducted a comprehensive review and update of our Inside Information Management Policy in 2024. The revised policy is designed to enhance our vigilance in handling sensitive information responsibly and in compliance with the latest regulatory, legal, and ethical standards. Furthermore, the topic of inside information continues to be a vital component of our annual internal training for senior management, addressing ongoing disclosure obligations under the Securities and Futures Ordinance and the Listing Rules.

External Auditor’s Remuneration and its Related Matters

The Company appointed Ernst & Young as the Company’s auditor (the “Auditor”). The Audit Committee is responsible for making recommendations to the Board on the appointment, re-appointment and removal of the Auditor, and to approve the remuneration and terms of engagement of the Auditor, and any questions of its resignation or dismissal.

For the year ended 31 December 2024, the Audit Committee reviewed and monitored the Auditor’s independence and objectivity and the effectiveness of the audit process in accordance with applicable standards. Details of the works performed by the Audit Committee in 2024 are set out in the Audit Committee Report in this annual report.

For the year ended 31 December 2024, the fees payable by the Company to the Auditor in respect of audit services, audit related services and non-audit services provided were as follows:

| |

RMB'000 |

| Audit services |

10,600 |

| Audit related services#: |

7,240 |

| Non-audit services: |

|

| • Tax service |

811 |

| • Others* |

2,375 |

# It comprised substantially the provision of audit related services for Wu Ling Power’s acquisition of certain clean energy project companies under the Proposed Asset Pre-Restructuring.

* It comprised substantially the provision of financial and taxation due diligence services related to the acquisition of Yuanda Environmental under the Proposed Asset Restructuring.

For details of the Proposed Asset Pre-Restructuring and Proposed Asset Restructuring, please refer to the Company’s announcements dated 30 September 2024, 18 October 2024 and 17 January 2025.

Whistleblowing and Anti-Corruption

Whistleblowing Policy

To ensure that the Company’s culture and values are adhere to and for good corporate governance practices, in order to help detect and deter misconduct and malpractices, the Board approved the launching of the Whistleblowing Policy in April 2012, for employees and those who deal with the Group, including customers and suppliers, and other stakeholders to raise concerns about the practices of the Group, in a secure and confidential manner.

In 2024, we undertook a comprehensive review and update of our Whistleblowing Policy to reinforce our dedication to good corporate governance practices. The enhancements reflect our commitment to protecting whistleblowers and fostering an environment where unethical behavior can be timely reported without fear of retaliation. The Internal Audit Department of the Group is tasked with managing any complaints received and investigating any improprieties. Findings are reported to the Audit Committee, which is responsible for determining any necessary follow-up actions.

Anti-corruption Policies

The Board and management of the Company are committed to anti-corruption and ethical business practices. As such the Company has formulated a series of anti-corruption policies since 2005 which are in compliance with the prevailing anti-corruption laws and regulations where our business operations and units are located. Anti-corruption seminars are mandatorily organized on a regular basis annually to educate our management and employees across the Group of the relevant laws and regulations and the measures the Company adopted to fight against corruption so as to foster our corporate culture of honesty and integrity.

For further information of our works done in respect of anti-corruption, please refer to the Sustainability Report 2024 of the Company as published on the websites of the Company and the Hong Kong Stock Exchange

Engagement with Workforce

The Board believes that employees are the most important resource for the sustainable development of the Company and to achieve its long-term goals, therefore, the Group has policies and mechanisms in place to ensure that the values and interests of employees align with that of the Company. Furthermore, there are channels for employees at all levels to provide feedback to management and the Board, thereby allowing the Board to be keep apprised of the expectations of employees and formulate appropriate policies to retain talented employees as well as attract talented individuals to join our Group.

Recruitment and Retention

The Group recruits fresh graduates, experienced professionals and other specialists to support its strategic development. At the same time, the Company promotes opportunities for internal career advancement for its employees. We offer competitive remuneration packages to employees at all levels and bonus tied to an employee’s performance with reference to a specific set of key performance indicators (KPIs).

Staff Development

The Group is committed to the continuous development of competence and ethical behavior of all employees. This provides a win-win situation for the Group and its employees, which on one hand, furthers the professional development of employees, and on the other hand, brings value to the Group by way of having a competent workforce.

We offer a wide range of learning resources for employees to support staff learning and development. To start with, all new joiners are provided with comprehensive induction training covering various aspects, such as the Group’s business, culture, values, history, corporate governance, anti-corruption, etc. Furthermore, we also offer job-specific training to employees depending on their position and job responsibilities, as well as education subsidies to eligible employees to pursue professional or academic qualifications and/or acquire job-related knowledge.

Staff Engagement Platform

The Company collaborated with Tencent Group to develop a tailor-made social communication mobile app named “Diantouyi” (電投壹) for our staff. This app facilitates two-way communication between employees and management in a more informal setting. The app includes various features that enables employees to receive news, participate in online training, access Group information, communicate with management and provide feedback, etc.

Incentive Schemes

To encourage management and employees to adhere to the Company’s strategic goals, values and culture, the Board adopted various incentive schemes to award management and employees who had contributed to achieving the Company’s strategic goals or had made positive impacts in promoting the Company’s culture and values. Most notably, the Company adopted the Share Incentive Scheme, which was approved by shareholders of the Company at the general meeting held on 15 June 2022, the purpose of which is to award employees with outstanding contribution to the further development of the Group and align its interests with the Group by way of equity ownership in the Company. For further information of the aforementioned share incentive scheme, please refer to the section headed “Share Incentive Scheme” in the Report of the Board of Directors in this annual report.

Workforce Diversity

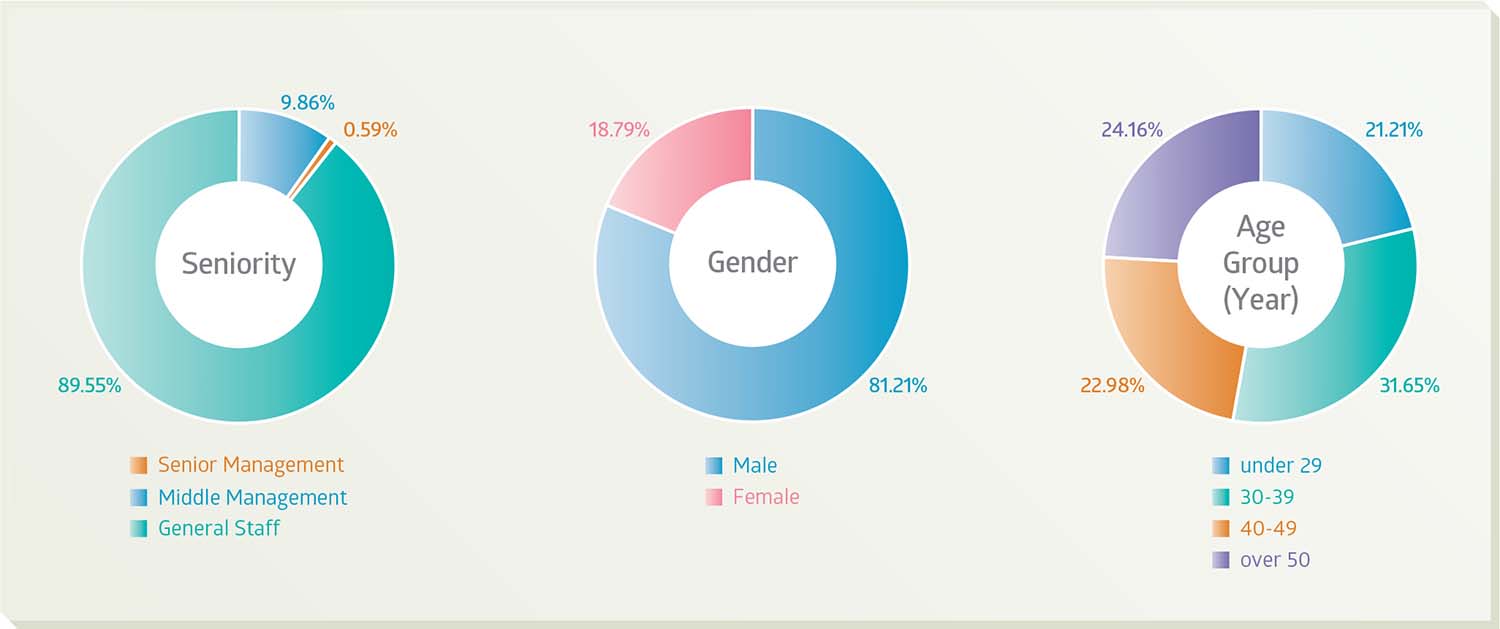

The Board has eight male directors and one female director as at 31 December 2024, the current male-to-female ratio of the Board is 8:1.

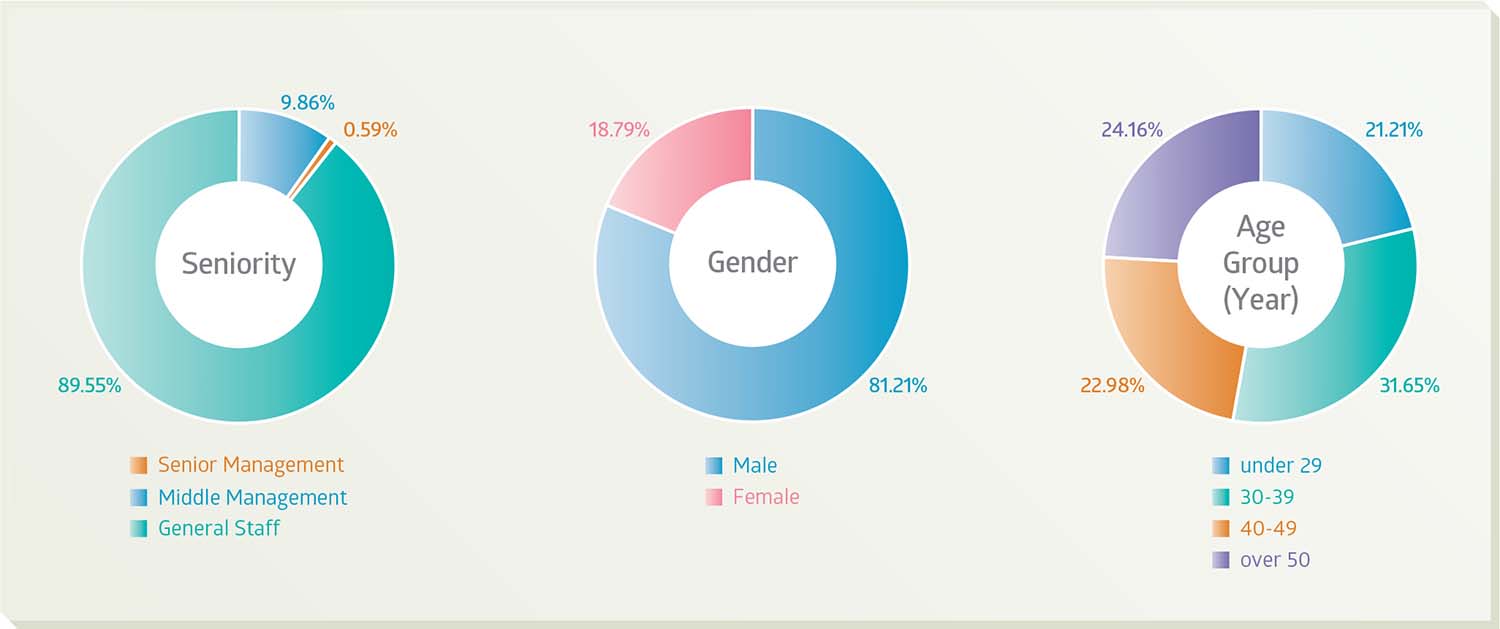

As at 31 December 2024, the Group had 14,776 employees, among which, 12,028 are male and 2,748 are female, i.e. a male- to-female ratio of approximately 8:2. Due to the inherent nature of the industry which the Group operates in, which involves intensive labour, it is historically a male dominated industry, and therefore the female employees of the Group is relatively low compared to other industries. However, if we focus on employees engaged in managerial and administrative work, including senior management and administrative executives, which is less labour intensive, the male-to-female ratio improved to approximately 7:3, reflecting a gender equality principle generally adhered by the Group.

The Company has implemented a series of policies to ensure that both male and female employees within the organization are

treated equally in all aspects of their work.

The diversity mix of employees of the Group are summarized in the following chart:

More details on the Group’s workforce diversity are set out in the Company’s Sustainability Report 2024.

Engagement with Shareholders

The Company maintains a corporate website at www.chinapower.hk where important and updated information about the

Group’s activities and corporate matters such as annual and interim reports, trading updates such as electricity sold of the Company, business development and operations, corporate governance practices and other information are available for review by shareholders and other stakeholders. When announcements are made through the Hong Kong Stock Exchange, the same information is made available on the Company’s website simultaneously.

Investor Relations

Apart from the annual general meeting held in 2024, the Board held various meetings with shareholders, investors and potential investors on other occasions to communicate with them on the Company’s strategies, goals and development direction, and to allow investors to provide us with feedback on areas which they believe improvement is needed from an investor’s perspective. The Board values the feedback received and designates relevant management to formulate plans for improvement.

The Company also holds regular press conferences and meetings with financial analysts and investors, during which the Company’s management will directly provide relevant information and data to the media, financial analysts, fund managers and investors, as well as answer their enquiries in a prompt, complete and accurate manner. The Company’s website is updated continuously, providing up-to-date information regarding every aspect of the Company to investors and the public.

The Company has a Capital Markets & Investor Relations Department, which takes charge of the Company’s relationship with investors and shareholders by providing information and services to them, promptly replying to their enquiries, and maintaining channels of active and timely communication with them.

Shareholders Communication Policy

In March 2012, the Board adopted a Shareholders Communication Policy of the Company which aims to set out the provisions with the objective of ensuring that the shareholders and potential investors are provided with ready, equal and timely access to balanced and understandable information about the Company, in order to enable shareholders to exercise their rights in an informed manner, and to allow shareholders and potential investors to engage actively with the Company. Summary of the Shareholders Communication Policy is as follows:

The Board shall maintain an on-going dialogue with shareholders and the investment community, and will regularly review this policy to ensure its effectiveness.

Information shall be communicated to shareholders and the investment community mainly through the Company’s financial reports (interim and annual reports), briefings for results and significant matters, and annual general meetings and other general meetings that may be convened, maintenance of communication with investment market and media, as well as making available all the Company’s disclosures, corporate communications and other corporate publications on a timely manner.

The channels for the shareholders to communicate their views to the Board are set out in the section headed “Shareholders’ Rights” below. The Shareholders Communication Policy of the Company is posted on the Company’s website under the “Corporate Governance Information” section.

The Chairman of the Board attended and chaired the Company’s annual general meeting and general meeting held on 6 June 2024 (the “AGM”), together with other Directors and the external independent auditor and answered questions from shareholders and investors at meetings. All resolutions proposed were duly passed by shareholders’ voting at the AGM.

Based on the Company’s shareholders engagement works carried out during the year, the Directors believe that the implementation of the Shareholders Communication Policy is effective and adequate. For further details, please refer to the section headed “Investor Relations and Frequently Asked Questions” in this annual report.

Dividend Policy

In January 2019, the Company has adopted a new Dividend Policy which aims to set out the provisions with the objective of providing stable dividends to shareholders.

The Company may declare and distribute annual cash dividends to its shareholders in an amount representing not less than 50% of the profit attributable to ordinary shareholders of the Company in any financial year, subject to the criteria set out in the Dividend Policy. In addition to cash, the dividends may be paid up in the form of the Company’s shares, by the distribution of specific assets of any kind or by distribution of any form.

A decision to declare or to pay any dividends, and the amount of dividends, will be based on the recommendation of the Board after taking into consideration of, inter alia, the following factors:

| (i) |

The financial results and financial condition of the Group;

|

| (ii) |

The Group’s actual and future operations and liquidity position;

|

| (iii) |

The Group’s expected working capital requirements, capital expenditure requirements and future expansion plans;

|

| (iv) |

The Group’s debt-to-equity ratio, return on equity and committed financial covenants;

|

| (v) |

The retained earnings and distributable reserves of the Company and each of the members of the Group;

|

| (vi) |

The general economic conditions, the national policies for energy and related industries, and other internal or external factors that may have an impact on the business or financial performance and position of the Company;

|

| (vii) |

The shareholders’ and the investors’ expectation and industry’s norm; and

|

| (viii) |

Any other factors that the Board deems appropriate.

|

The Company shall prioritize payment of cash dividends to its shareholders. Such declaration and payment of dividends shall be determined at the sole discretion of the Board and subject to all applicable requirements under the Hong Kong Company Ordinance and the articles of association of the Company.

Shareholders' Rights

Procedures for Shareholders to Convene General Meeting

Shareholders are entitled to have right to request the Company to convene a general meeting pursuant to Part 12 of the Hong Kong Companies Ordinance. The procedures are as follows:

The Directors are required to call a general meeting if the Company has received requests to do so from the Shareholders representing at least 5% of the total voting rights of all the members having a right to vote at general meetings.

A request -

| (a) |

must state the general nature of the business to be dealt with at the general meeting; and

|

| (b) |

may include the text of a resolution that may properly be moved and is intended to be moved at the general meeting.

|

Requests may consist of several documents in like form that –

| (a) |

may be sent to the Company in hard copy form or in electronic form; and

|

| (b) |

must be authenticated by the person or persons making it.

|

Directors must call a general meeting with 21 days after the date on which they become subject to the requirement, and must be held on a date not more than 28 days after the date of the notice convening the general meeting.

If the requests received by the Company identify a resolution that may properly be moved and is intended to be moved at the general meeting, the notice of the general meeting must include notice of the resolution.

If the resolution is to be proposed as a special resolution, the Directors are to be regarded as not having duly called the general meeting unless the notice of the general meeting includes the text of the resolution and specifies the intention to propose the resolution as a special resolution.

Notice and Voting of General Meetings

Sufficient notice of shareholders meeting and the procedures for voting conduction will be given to the shareholders prior to every general meeting. Save as provided under the Listing Rules, resolutions put to vote at the general meetings of the Company (other than procedural matters) are taken by poll. Procedures regarding the conduct of the poll are explained to the shareholders at the commencement of each general meeting, and questions from shareholders regarding the voting procedures are answered. The poll results are posted on the respective websites of the Company and the Hong Kong Stock Exchange on the same day of the poll.

Procedures for Shareholders Sending Enquiries to the Board

Shareholders should direct their questions about their shareholdings to the Company’s registrar and whose details are as follows:

Computershare Hong Kong Investor Services Limited

Shops 1712-1716, 17/F., Hopewell Centre, 183 Queen’s Road East, Wanchai, Hong Kong

Tel: (852) 2862 8628

Fax: (852) 2865 0990

The Company Secretary and the Capital Markets & Investor Relations Department of the Company also handle both telephone and written enquiries from shareholders from time to time. Shareholders’ enquiries and concerns will be forwarded to the Board and/or relevant Board committees of the Company, where appropriate, to answer the shareholders’ questions. For shareholders and investors’ enquiries, the contact information is set out in the section headed “Useful Information for Investors” in this annual report.

Other Procedures for Shareholders’ Proposals

The details of the following procedures are available at the Company’s website www.chinapower.hk under the “Corporate Governance” section for review.

Constitutional Documents

The Company’s constitutional documents have been posted on the Company’s website www.chinapower.hk under the “Corporate Governance” section. During the year under review, there was no change in the Company’s articles of association.

Important Shareholders Dates

The important shareholders dates in the coming financial year are set out in the section headed “Useful Information for Investors” in this annual report.