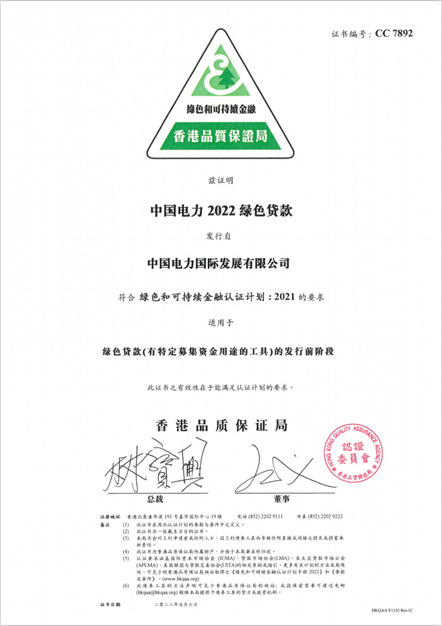

CPID Passes Green Finance Certification by HKQAA

Recently, the RMB2 billion loan project between CPID and CCB Hong Kong Branch passed the Green Finance Certification for Pre-Issuance Stage by the Hong Kong Quality Assurance Agency (HKQAA), in recognition of CPID's contribution to environmental protection and energy conservation and emission reduction.

The green loan is a green financing instrument adopted by CPID to fully promote the implementation of the company's clean transformation strategy. As the first listed power company of the Mainland in Hong Kong, CPID has passed this certification and demonstrated the company's social responsibility and commitment to green development.

The Green Finance Certification Scheme enhances the credibility of CPID in the clean energy sector and the confidence of the investors, and helps attract more potential green finance investors in CPID.

Green finance is an important strategic instrument for China to promote the economic development and regional cooperation in the Guangdong-Hong Kong-Macao Greater Bay Area and the Belt and Road region. In line with the development of China's green finance policy and with the promotion and support of the HKSAR Government, HKQAA officially launched the Green Finance Certification Scheme in 2018 to provide collaborative vendor certification services for green finance issuers. The scheme aims to help the financial sector explore new opportunities in the green finance market, promote the concept of green finance, and promote environment-friendly investments in Hong Kong, Mainland China and the world to facilitate the development of green finance and industry.